NO.PZ201710200100000104

问题如下:

4. Assume that a new government takes office in Canada. If Peters and her team use the Gordon growth model and assume that Company ABC stock is fairly valued, then which of the following would most likely be true?

选项:

A.The total return of ABC stock will be 10.85%.

B.The dividend yield of ABC stock will be 3.85%.

C.The stock price of ABC will grow at 7.35% annually.

解释:

B is correct.

In the Gordon growth model, Total return = Dividend yield + Capital gains yield (i.e., constant growth rate). When a stock is fairly valued, the expected total return will equal the required return or discount rate (i.e., 7.35%). In the case of ABC, the total return is 7.35% and the capital gains yield is 3.5%. Therefore, the dividend yield is 7.35% – 3.5% = 3.85%

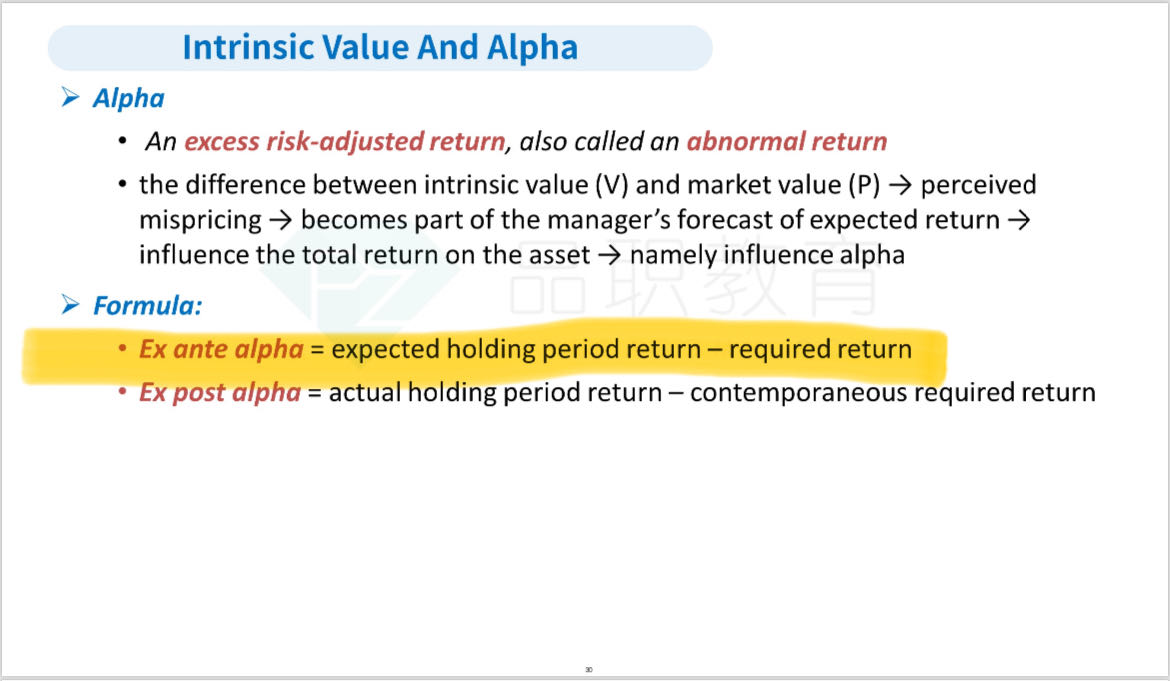

When a stock is fairly valued, the expected total return will equal the required return or discount rate 这是结论吗 怎么推出来的