NO.PZ202206210100000102

问题如下:

During Phase 2, OHF’s external manager selection and retention policy was most likely susceptible to which of the following biases?选项:

A.Endowment bias B.Loss aversion bias C.Representative bias解释:

SolutionC is correct. Representative (or recency) bias is the tendency to overweight the importance of the most recent observations and information compared with information arising from a longer-term set of observations. For this situation, it implies that those managers who outperformed their peers in at least the prior two years would continue to do so in future periods.

B is incorrect. Loss aversion is a bias in which individuals tend to strongly prefer avoiding losses as opposed to achieving gains. The basis for hiring and retaining managers was not based on gains or losses but, rather, was performance relative to that of their peers.

A is incorrect. The endowment bias is the bias that individuals ascribe more value to things merely because they already own them.

好像没印象学过这个章节的内容。

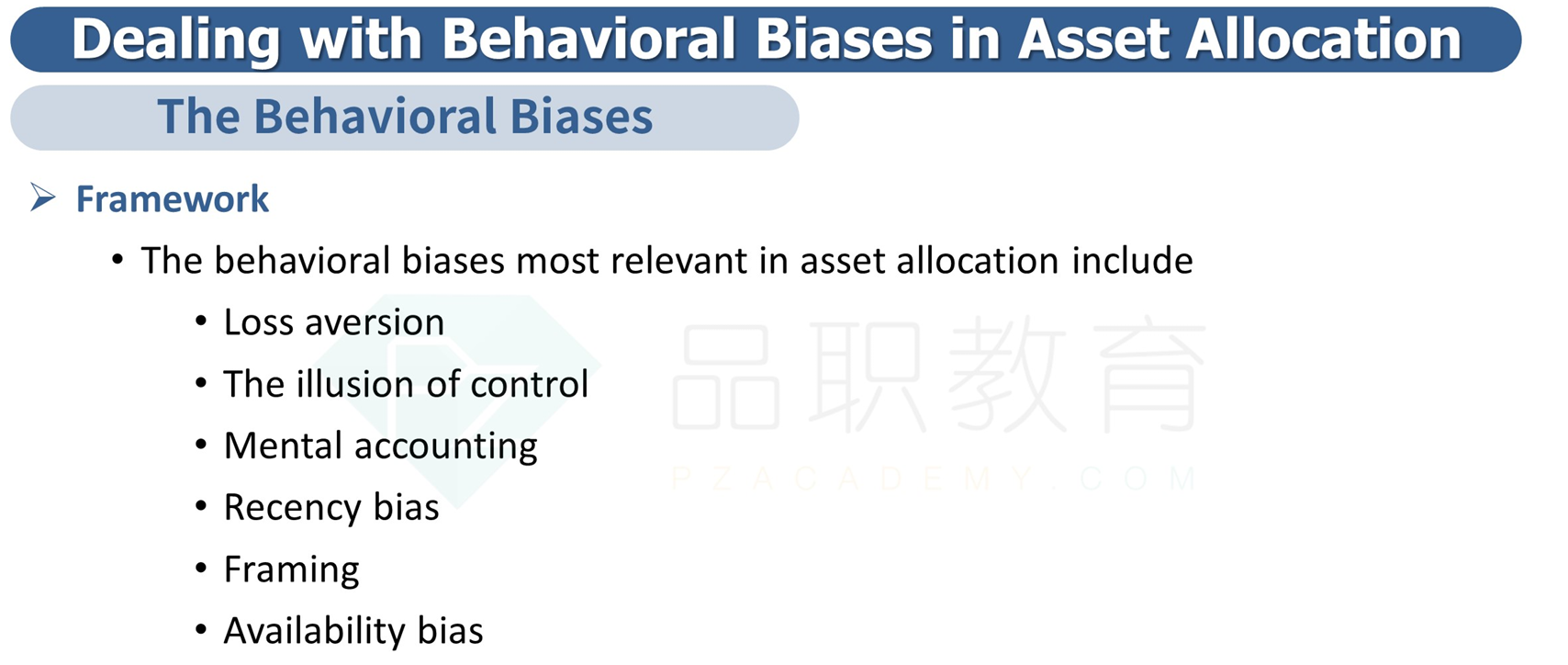

还有哪些bias?