NO.PZ202304070100009104

问题如下:

Ibarra wants to know the credit spread of bond B2 over a theoretical comparable-maturity government bond with the same coupon rate as this bond. The foregoing credit spread is closest to:

选项:

A.108 bps.

101 bps.

225 bps.

解释:

Correct Answer: A

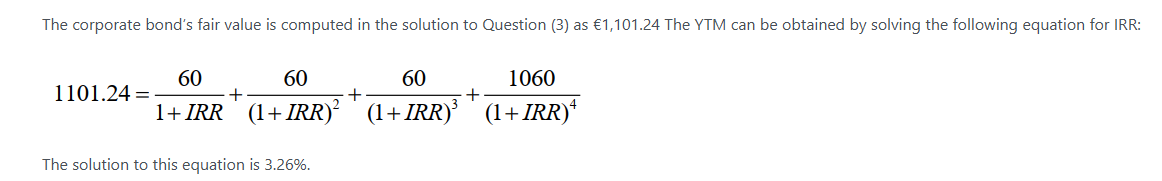

The corporate bond’s fair value is computed in the solution to Question (3) as €1,101.24 The YTM can be obtained by solving the following equation for IRR:

The solution to this equation is 3.26%.

Valuation of a four-year, 6% coupon bond under no default (VND) is computed in the solution to Question (3) as 1,144.63. So, the YTM of a theoretical comparable-maturity government bond with the same coupon rate as the corporate bond B2 can be obtained by solving the following equation for IRR:

The solution to this equation is 2.18%. So, the credit spread that the analyst wants to compute is 3.26% – 2.18% = 1.08%, or 108 bps.

老师,我这里用计算器:N=4 PV=-1101.24 PMT=60 FV=1060,求I/Y怎么答案不一样?