NO.PZ2023100703000043

问题如下:

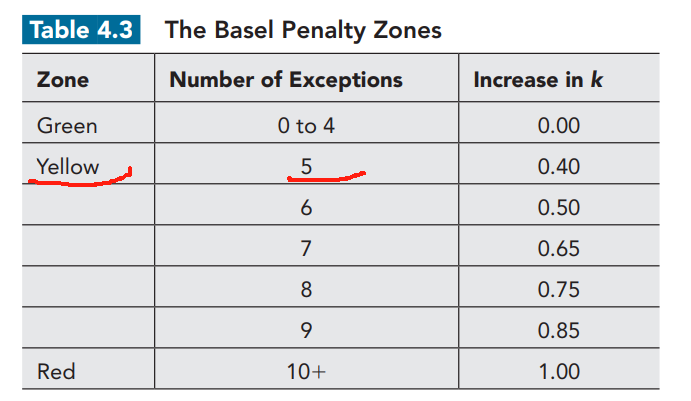

A bank's risk analyst is backtesting an internal VAR model used to measure market risk at a 99% confidence level, with 250 daily returns and five exceptions observed. According to the Basel regulatory framework, which of the following is correct to incorporate backtesting into the internal model approach of market risk capital requirements?选项:

A.The Basel backtesting framework assumes that exceptions are serially related. B.The bank is in the yellow zone as the Basel Committee does not accept five exceptions. C.Analysts can improve the reliability of the test by increasing the confidence of the test from 99% to 99.9%. D.When backtesting VAR model, analysts should choose a low type II error rate, because this is a requirement of Basel backtesting framework.解释:

A Basel Committee does not assume that the exception sequence is relevant C the reliability of the test is decreased by increasing the confidence of the test from 99% to 99.9%. D There are no relevant requirements in the backtesting framework.讲一下b的知识点呗