NO.PZ202206140600000606

问题如下:

Teamwork Advisory, LLC_1 Case Scenario

Teamwork Advisory, LLC, was recently formed by a group of friends who attended graduate school together. Charlie Godwin and Susan Zhang lead the private client services division of the company. They have several funds under consideration to recommend to clients but want to be more confident about the abilities of the fund managers. Godwin suggests preparing a detailed performance evaluation of each manager.

Zhang comments to Godwin that she intends to calculate the return due to the manager’s style for each fund and use benchmarking to determine how the manager performed relative to others with similar styles. She has collected data for two large stock funds the firm might recommend (Exhibit 1) and presents the information to Godwin.

Exhibit 1. Annual Average Performance Metrics over Past 120 Months

Godwin tells Zhang that they should be careful about drawing conclusions before determining whether the benchmark is appropriate. To determine whether it is appropriate, they need to look at the correlation between the active management return and the style return for the portfolio.

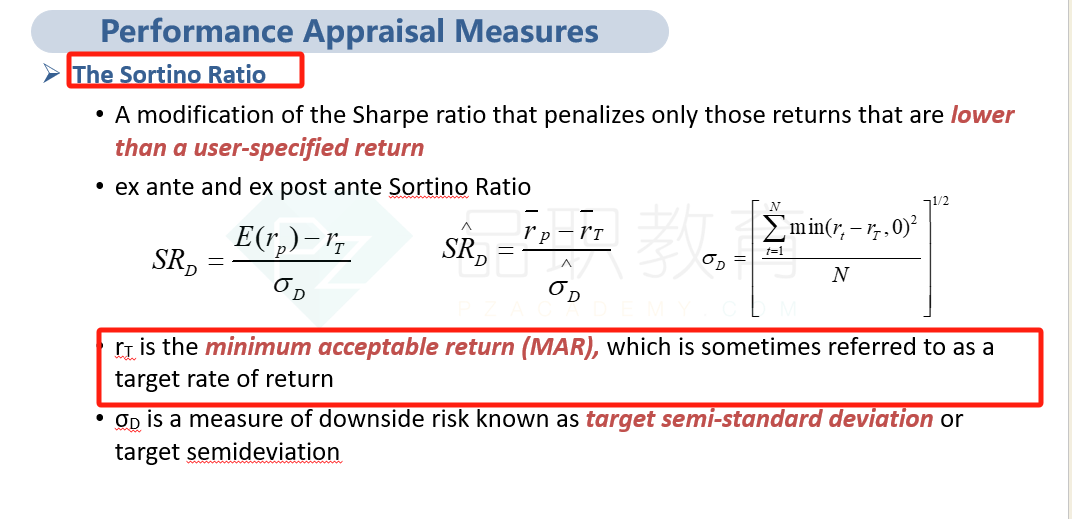

Rajesh Rao, a colleague who leads the quantitative analysis group at Teamwork, joins the conversation. He tells the others that he prefers to focus on performance metrics for the funds themselves. He thinks that is what really matters to the client, because managers are often replaced with others of similar style. He believes that the Sortino ratio is a good choice in making this assessment and recommends using Zhang’s data (Exhibit 1) for this calculation. Rao identifies three reasons that the Sortino ratio is a better measure of fund performance than the Sharpe ratio. The Sortino ratio

is preferred when the investor’s goal is to preserve capital.

offers the ability to more accurately assess performance when the return distribution is not symmetrical.

uses a target return that is based on market conditions rather than individual investor preferences.

Godwin reminds Rao that Teamwork is seeking long-term client strategies and that they must protect against market downturns. He suggests Rao also calculate downside capture ratios for the funds they are considering. Rao calls an assistant, who brings him some data for a different fund, Fund C.

Exhibit 2 Return Data for Fund C and Benchmark

Rao informs Zhang that Fund B, described in her first dataset, has a capture ratio of 117%. He suggests that she prepare an interpretation of this result to include with her fund analysis.

Which of Rao’s reasons for preferring the Sortino ratio over the Sharpe ratio is least accurate?

选项:

A.Reason 1 B.Reason 2 C.Reason 3解释:

SolutionC is correct. Rao’s third reason is not accurate. Sortino ratios use investor-specific preferences rather than market conditions.

A is incorrect. Reason 1 is accurate. The Sortino ratio compares the portfolio return with a minimum acceptable return rather than with a benchmark.

B is incorrect. Reason 2 is accurate. The Sortino ratio offers the ability to more accurately assess performance when return distributions are not symmetrical. The Sharpe ratio assumes symmetrical returns.

大概什么样的收益率是market conditions呢?无风险收益率之类的吗?