NO.PZ201805280100000203

问题如下:

Elsbeth Quinn and Dean McCall are partners at Camel Asset Management (CAM).Quinn advises high- net- worth individuals, and McCall specializes in retirement plans for institutions.

Quinn meets with Neal and Karina Martin, both age 44. The Martins plan to retire at age 62. Twenty percent of the Martins’ $600,000 in financial assets is held in cash and earmarked for funding their daughter Lara’s university studies, which begin in one year. Lara’s education and their own retirement are the Martins’ highest- priority goals. Last week, the Martins learned that Lara was awarded a four- year full scholarship for university. Quinn reviews how the scholarship might affect the Martins’asset allocation strategy.

The Martins have assets in both taxable and tax- deferred accounts. For baseline retirement needs, Quinn recommends that the Martins maintain their current overall 60% equity/40% bonds (± 8% rebalancing range) strategic asset allocation. Quinn calculates that given current financial assets and expected future earnings, the Martins could reduce future retirement savings by 15% and still comfortably retire at 62. The Martins wish to allocate that 15% to a sub- portfolio with the goal of making a charitable gift to their almamater from their estate. Although the gift is a low- priority goal, the Martins want the sub- portfolio to earn the highest return possible. Quinn promises to recommend an asset allocation strategy for the Martins’ aspirational goal.

Next, Quinn discusses taxation of investments with the Martins. Their interest income is taxed at 35%, and capital gains and dividends are taxed at 20%. The Martins want to minimize taxes. Based on personal research, Neal makes the following two statements:

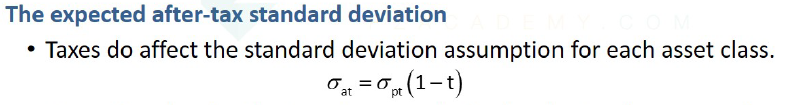

Statement 1 The after- tax return volatility of assets held in taxable accounts will be less than the pre- tax return volatility.

Statement 2 Assets that receive more favorable tax treatment should be held in tax- deferred accounts.

The equity portion of the Martins’ portfolios produced an annualized return of 20% for the past three years. As a result, the Martins’ equity allocation in both their taxable and tax- deferred portfolios has increased to 71%, with bonds falling to 29%.The Martins want to keep the strategic asset allocation risk levels the same in both types of retirement portfolios. Quinn discusses rebalancing; however, Neal is somewhat reluctant to take money out of stocks, expressing confidence that strong investment returns will continue.

Quinn’s CAM associate, McCall, meets with Bruno Snead, the director of the Katt Company Pension Fund (KCPF). The strategic asset allocation for the fund is 65% stocks/35% bonds. Because of favorable returns during the past eight recession- free years, the KCPF is now overfunded. However, there are early signs of the economy weakening. Since Katt Company is in a cyclical industry, the Pension Committee is concerned about future market and economic risk and fears that the high- priority goal of maintaining a fully funded status may be adversely affected. McCall suggests to Snead that the KCPF might benefit from an updated IPS.

Following a thorough review, McCall recommends a new IPS and strategic asset allocation. The proposed IPS revisions include a plan for short- term deviations from strategic asset allocation targets. The goal is to benefit from equity market trends by automatically increasing (decreasing) the allocation to equities by 5% whenever the S&P 500 Index 50- day moving average crosses above (below) the 200- day moving average.

Which of Neal’s statements regarding the taxation of investments is correct?

选项:

A.Statement 1 only

B.Statement 2 only

C.Both Statement 1 and Statement 2

解释:

A is correct.

Taxes alter the distribution of returns by both reducing the expected mean return and muting the dispersion of returns. The portion of an owner’s taxable assets that are eligible for lower tax rates and deferred capital gains tax treatment should first be allocated to the investor’s taxable accounts.

考点:taxable investor

解析:Statement 1正确,应税账户资产的税后波动率低于税前波动率。Statement 2错误,资产本身有一些税收优惠的,可以放在taxable account,没有税收优惠的资产可以放在tax- deferred accounts递延纳税时间,因此Statement 2描述反了。因此A选项正确。

hello, 这个选项我还有这种理解:因为CGT , income tax税收是不一样的,那么在pre- tax expected return一样的组合把tax剔除后 return相差会很多,这样的话after tax return volatility难度不是更大或者更高吗?请问老师怎么理解的?