NO.PZ2023120801000080

问题如下:

For changes in yield-to-maturity, the convexity adjustment is most needed to account for the:

选项:

A.first-order effect on bond prices.

bond price risk due to small changes in yield-to-maturity.

non-linear relationship of bond prices and yield to maturity.

解释:

Correct Answer: C

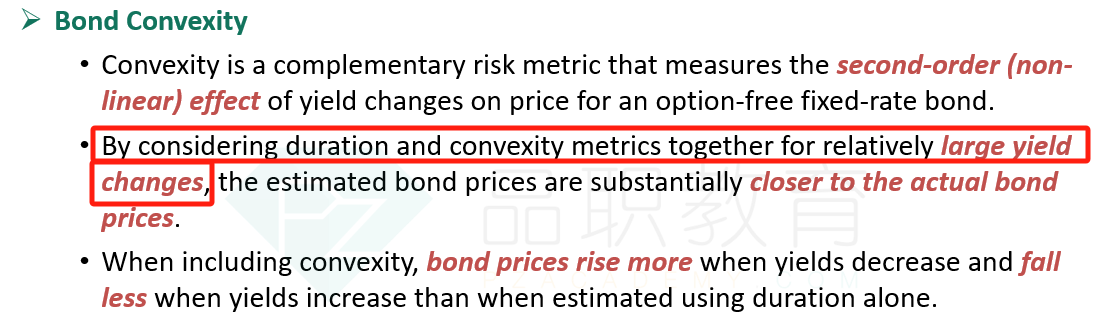

The convexity adjustment is a complementary risk measure to duration. It accounts for the second-order (non-linear) effect of yield changes on price. It is most useful for large yield changes, because duration provides a good approximation for small yield changes.

1