NO.PZ2023091802000158

问题如下:

An oil driller

recently issued USD 250 million of fixed-rate debt at 4.0% per annum to help

fund a new project. It now wants to convert this debt to a floating-rate

obligation using a swap. A swap desk analyst for a large investment bank that

is a market maker in swaps has identified four firms interested in swapping

their debt from floating-rate to fixed-rate. The following table quotes

available loan rates for the oil driller and each firm:

A swap between the oil driller and which firm offers the greatest possible combined benefit? (Practice Exam)

选项:

A.Firm A

B.Firm B

C.Firm C

D.Firm D

解释:

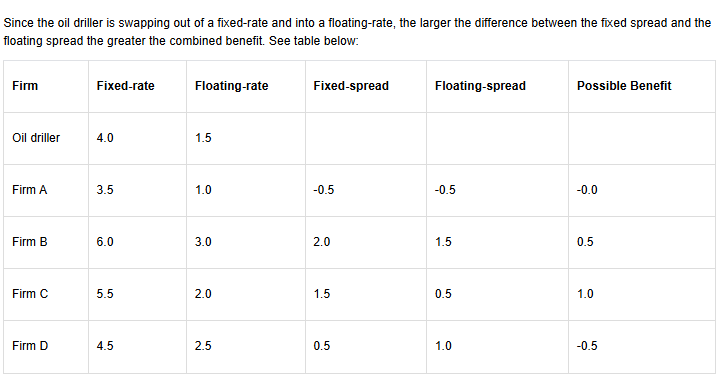

Since

the oil driller is swapping out of a fixed-rate and into a floating-rate, the

larger the difference between the fixed spread and the floating spread the

greater the combined benefit. See table below:

老师您好,这题答案的图片显示不出来