NO.PZ2023040501000015

问题如下:

John Thronen is an analyst in the research department of an international securities firm. He is preparing a research report on Topmaker, Inc., a publicly traded company that complies with IFRS. On 1 January 2016, Topmaker acquired a 15% equity interest with voting power in Rainer Co. for $300 million. Topmaker has representation on Rainer’s board of directors and participates in Rainer’s policymaking process.

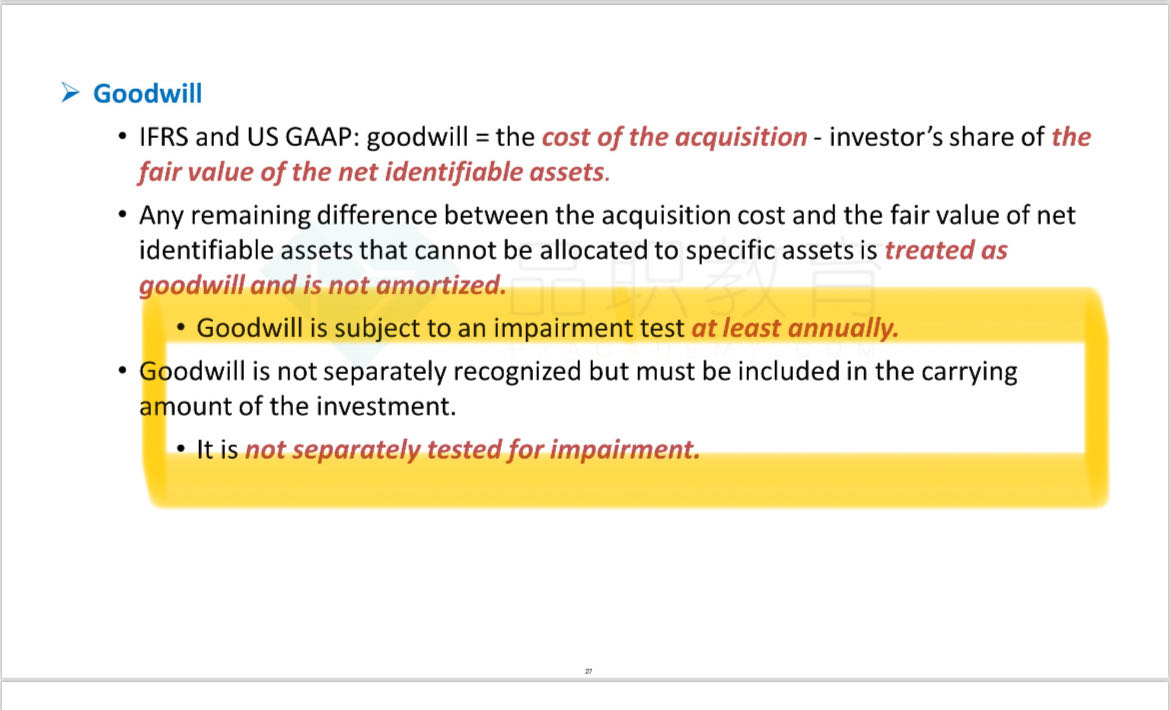

Thronen is concerned about possible goodwill impairment resulting from expected changes in the industry effective at the end of 2017. He calculates the impairment loss based on the projected consolidated balance sheet data shown in Exhibit 3, assuming that the cash-generating unit and reporting unit of Topmaker are the same.

Based on Exhibit 3, Topmaker’s impairment loss under IFRS is:

选项:

A.$120 million.

$300 million.

$400 million.

解释:

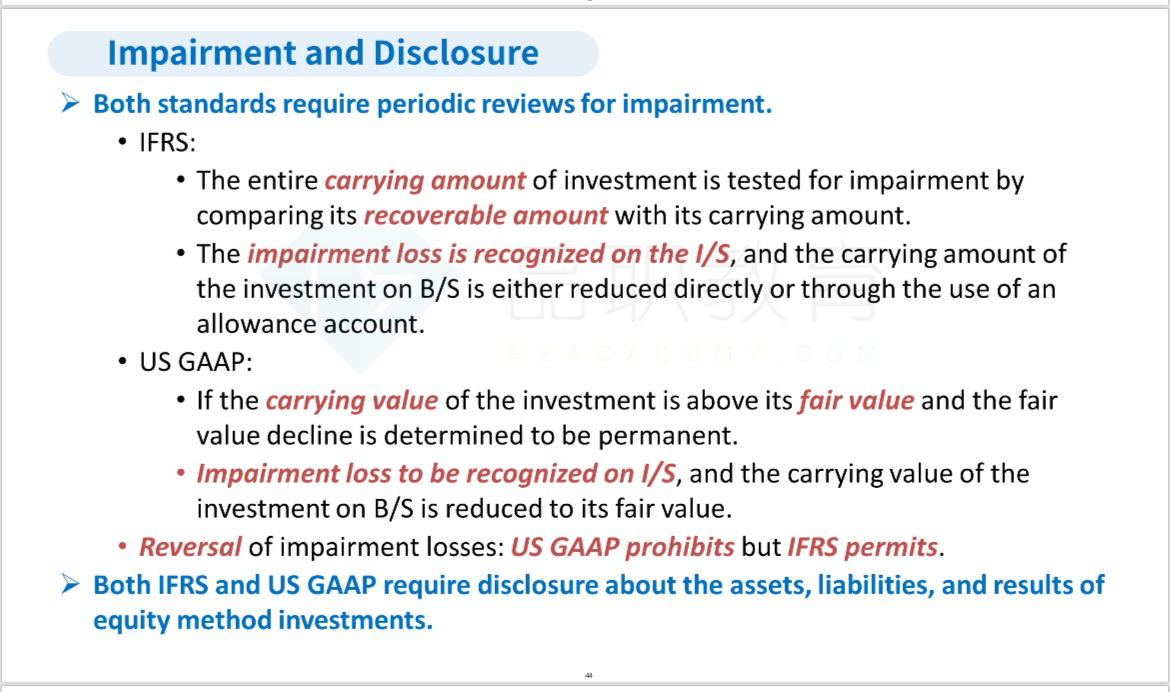

The goodwill impairment loss under IFRS is $300 million and is calculated as the difference between the recoverable amount of a cash-generating unit and the carrying value of the cash-generating unit. Topmaker’s recoverable amount of the cash-generating unit is $14,900 million, which is less than the carrying value of the cash-generating unit ($15,200 million). The result is an impairment loss of $300 million ($14,900 – $15,200).

老师,equity method下不是不涉及goodwill impairment吗?它又没有并表,哪里来的goodwill。equity method下的减值只有investment impairment对吗,为啥题目这里问的是goodwill impairment呢?