老师,这题的意思没太读懂,尤其是“The analyst comments that because the modified duration and the creditspread duration of the EKN bond are equal, the bond’s price will not change(all else being equal) in response to the interest rate and credit spread changes.”没懂

pzqa31 · 2024年07月21日

嗨,从没放弃的小努力你好:

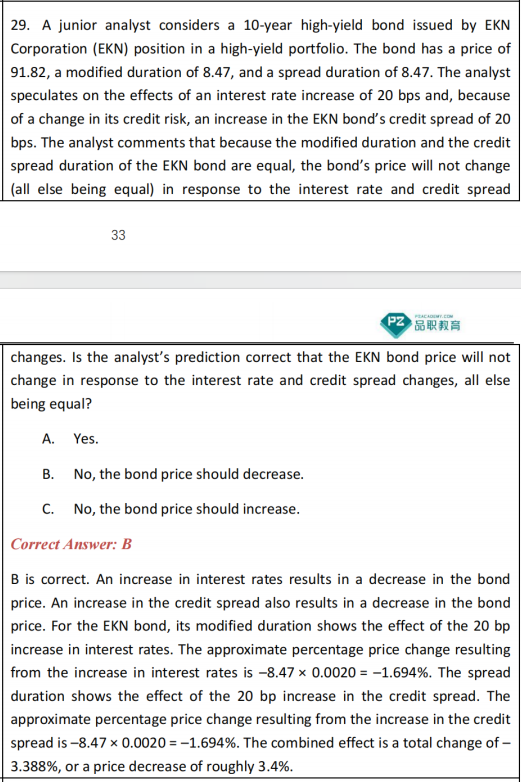

这道题考察的是yc=yb+spread,yb与spread都变动,对yc的影响,进而计算出对债券价格的影响。

The analyst speculates on the effects of an interest rate increase of 20 bps and, because of a change in its credit risk, an increase in the EKN bond’s credit spread of 20 bps.

----这句话的意思是说yb和spread都上升了20bp

The analyst comments that because the modified duration and the credit spread duration of the EKN bond are equal, the bond’s price will not change (all else being equal) in response to the interest rate and credit spread changes.

----这句话的意思是,因为modified duration=credit spread duration,所以债券价格也不会改变(因为上一句话说到的yb和spread也都是同样是上升了20bp)这句话是错误的。

这道题考察的是yc=yb+spread,yb与spread都变动,对yc的影响,进而计算出对债券价格的影响。由于利率变动对债券价格的影响,可以用Modified duration来衡量,根据公式,可知债券价格上升:10bps ×8.87;同时由于债券的Spread减少带来的价格上升为:10 bps×8.87;所以综合来看利率下降、Spread减少对债券的影响为:2×10bps ×8.87.选B

----------------------------------------------

加油吧,让我们一起遇见更好的自己!