Carol文_品职助教 · 2024年07月17日

嗨,努力学习的PZer你好:

学员,你好。这道题是没有问题的哈。

题目: Top-down 参与方式最有可能是: A: 与主动投资组合相比,更符合被动投资组合。 B: 涉及与各个公司的董事会进行讨论。 C: 专注于环境和社会问题,而不是治理问题。

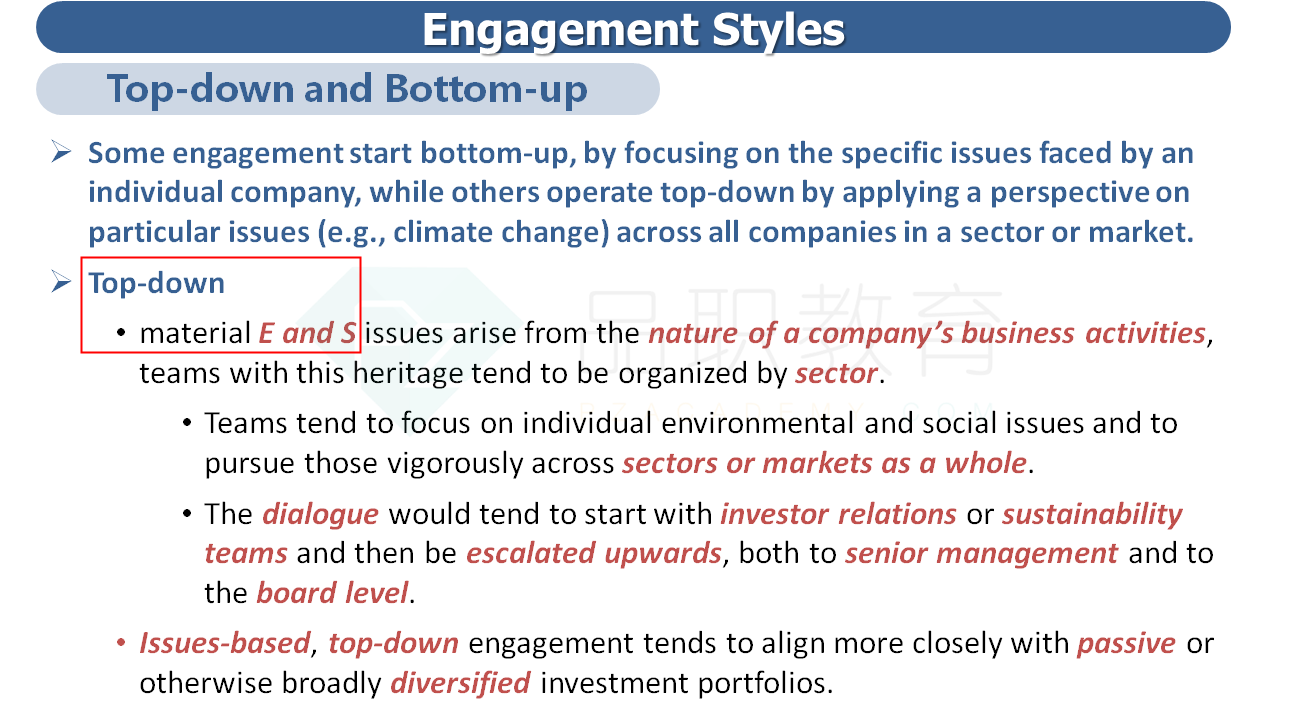

正确答案: C 是正确的,因为“团队往往专注于个别的环境和社会问题,并在整个行业或市场中积极推动这些问题……而具有治理背景的公司往往专注于个别公司……这些是概括,但它们说明了自上而下和自下而上活动之间的区别。”因此,具有环境主导背景的公司通常从事自上而下的活动,而治理主导的公司则专注于自下而上的活动。

A 是错误的,**因为“公司专注的、自下而上的参与方式最自然地符合主动投资方法……而基于问题的、自上而下的参与方式更倾向于与被动或其他广泛多元化的投资组合相一致。”

B 是错误的,**因为“团队往往专注于个别的环境和社会问题,并在整个行业或市场中积极推动这些问题……而具有治理背景的公司往往专注于个别公司,从董事会主席开始……并逐一联系董事会成员……这些是概括,但它们说明了自上而下和自下而上活动之间的区别。”因此,涉及联系个别公司的活动是与治理背景相关的自下而上的活动。

综上所述,选项 C 是正确的,因为它准确描述了自上而下的参与方式的特征,即关注环境和社会问题而非公司治理问题。

具体详见第六章以下讲义内容。

----------------------------------------------加油吧,让我们一起遇见更好的自己!

答案判断及提示不正确 自上而下更关注的是治理问题。

NO.PZ2022120703000051 问题如下 A top-wn engagement style most likely: A.aligns more closely with active rather thpassive portfolios. B.involves scussions with the boar of invicompanies. C.focuses on environmentansociissues rather thgovernanissues. C is correbecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies...these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, firms with environmental-leheritage typically engage in top-wn activity while governance-lefirms focus on bottom-up activity.A is incorrebecause \"company-focuse bottom-up engagement fits most naturally with active investment approaches...whereissue-base top-wn engagement ten to align more closely with passive or otherwise broay versifieinvestment portfolios.\"B is incorrebecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies, starting with the chair...anworking through the boar..these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, it is the bottom-up activity (associatewith firms with governanheritage) whiinvolves contacting invicompanies. 为什么E和S要至上而下,G要至下而上啊? 不理解 基础课程什么地方有具体讲解吗?

NO.PZ2022120703000051 问题如下 A top-wn engagement style most likely: A.aligns more closely with active rather thpassive portfolios. B.involves scussions with the boar of invicompanies. C.focuses on environmentansociissues rather thgovernanissues. C is correbecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies...these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, firms with environmental-leheritage typically engage in top-wn activity while governance-lefirms focus on bottom-up activity.A is incorrebecause \"company-focuse bottom-up engagement fits most naturally with active investment approaches...whereissue-base top-wn engagement ten to align more closely with passive or otherwise broay versifieinvestment portfolios.\"B is incorrebecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies, starting with the chair...anworking through the boar..these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, it is the bottom-up activity (associatewith firms with governanheritage) whiinvolves contacting invicompanies. 被动投资和主动投资的engagement metho什么本质区别吗?我理解主动需要更加活跃的engagement,除此之外还有区别吗?

NO.PZ2022120703000051问题如下 A top-wn engagement style most likely: A.aligns more closely with active rather thpassive portfolios.B.involves scussions with the boar of invicompanies.C.focuses on environmentansociissues rather thgovernanissues. C is correbecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies...these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, firms with environmental-leheritage typically engage in top-wn activity while governance-lefirms focus on bottom-up activity.A is incorrebecause \"company-focuse bottom-up engagement fits most naturally with active investment approaches...whereissue-base top-wn engagement ten to align more closely with passive or otherwise broay versifieinvestment portfolios.\"B is incorrebecause \"teams tento focus on invienvironmentansociissues anto pursue those vigorously across sectors or markets a whole...while firms with governanheritage tento focus on invicompanies, starting with the chair...anworking through the boar..these are generalisations but they illustrate the stinction between top-wn anbottom-up activity.\" Hence, it is the bottom-up activity (associatewith firms with governanheritage) whiinvolves contacting invicompanies. 老师请问A是什么,