NO.PZ202301040900001002

问题如下:

(2) Recommend a new investment approach based for the Whatsit’s pension plan that is most likely to outperform the market. Justify your response and identify one advantage and one disadvantage of this approach.

选项:

解释:

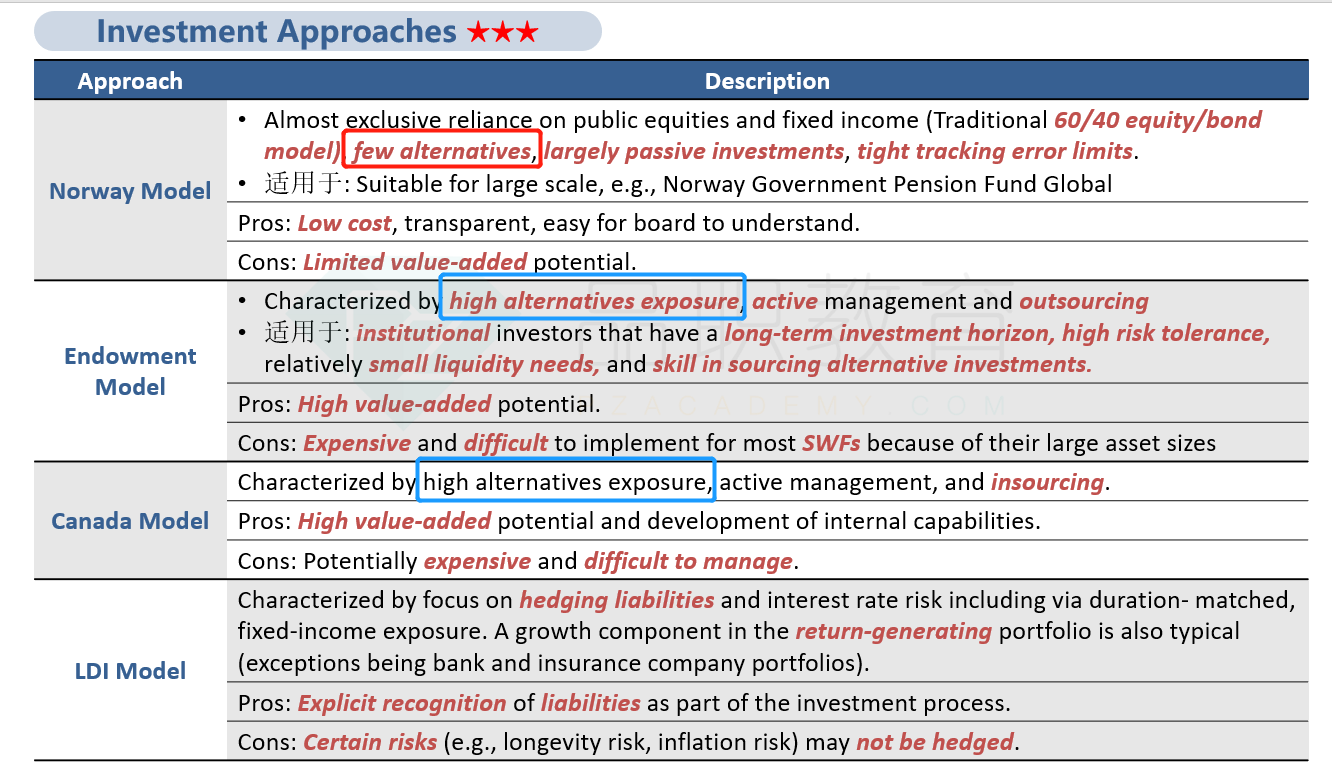

Whatsit should use the endowment model.

Justification (either two of these is acceptable):

Long time horizon

High risk tolerance

Relatively small liquidity needs

Stuart’s experience with external managers to help with investment

Advantage:

Ability to capture alpha and outperform the market over a long-time horizon, that is, high value-added potential.

Disadvantages (either one of these is acceptable):

The endowment model is costly because of high alternative exposure, active management and outsourcing compared to a passive approach.

Difficult to implement if fund has large asset size.

老师,可否请您看一下我答案的分析,我看了答案还是没想明白为什么是endowment,我看了题干,觉得信息都在偏向LDI呀?

The new approach advised may be the LDI model.

Because there is 5% legal spending need for the benefit payments for the retired employees, the firm indeed needs to invest in some of fixed income securities in the reserve portfolio. Although the plan is underfunded now, the firm remains the market leader and has a strong financial situation, allowing to contribute the plan in time.

Meanwhile, the company hires many young workers in order to make the average age of the workforce remain low, leading to a less mature pension plan. So there is low liquidity needs and high risk tolerance. As the recent declining sales, the firm should consider making the growth of assets higher than growth of liabilities, so it is urgent to invest in alternatives or riskier securities in return seeking portfolio in pursuit of above-market returns.