NO.PZ2023040501000075

问题如下:

Pedro Ruiz is an analyst for a credit rating agency. One of the companies he follows, Eurexim SA, is based in France and complies with International Financial Reporting Standards (IFRS). Ruiz has learned that Eurexim used EUR220 million of its own cash and borrowed an equal amount to open a subsidiary in Ukraine. Ukraine is not currently in a hyperinflationary environment, but Ruiz is concerned that this situation could change. Ruiz also believes the euro will appreciate against the hryvnia for the foreseeable future.

Given Ruiz’s belief about the direction of exchange rates, Eurexim’s gross profit margin would be highest if it accounts for the Ukraine subsidiary’s inventory using:

选项:

A.FIFO and the temporal method.

FIFO and the current rate method.

weighted-average cost and the temporal method.

解释:

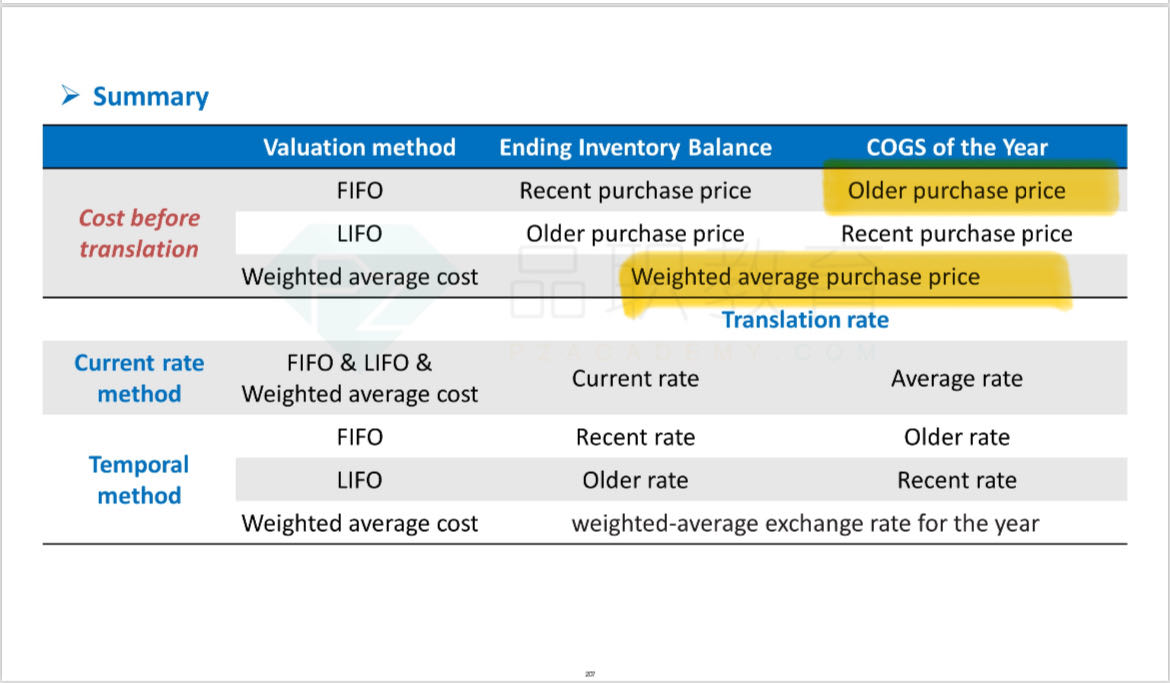

Ruiz expects the EUR to appreciate against the UAH and expects some inflation in the Ukraine. In an inflationary environment, FIFO will generate a higher gross profit than weighted-average cost. For either inventory choice, the current rate method will give higher gross profit to the parent company if the subsidiary’s currency is depreciating. Thus, using FIFO and translating using the current rate method will generate a higher gross profit for the parent company, Eurexim SA, than any other combination of choices.

Revenue大家都用的Avg,问题出在COGS上,B用的是Avg,C用的是Weight,这两个汇率看不出大小吧,加权平均和平均如何比,题干没有信息