NO.PZ2020011303000206

问题如下:

Under what circumstances is the carry roll-down the same for the following three assumptions: (a) forward rates are realized, (b) term structure is unchanged, and (c) yield to maturity is unchanged?

解释:

If the term structure is flat, the carry roll-down will be the same for all three definitions.

题目问:在什么情况下,以下三个假设的carry roll-down相同:(a) 远期利率已实现,(b) 期限结构不变,(c) 到期收益率不变?

当利率的期限结构是flat的时候,这三种情况的carry roll down相同。

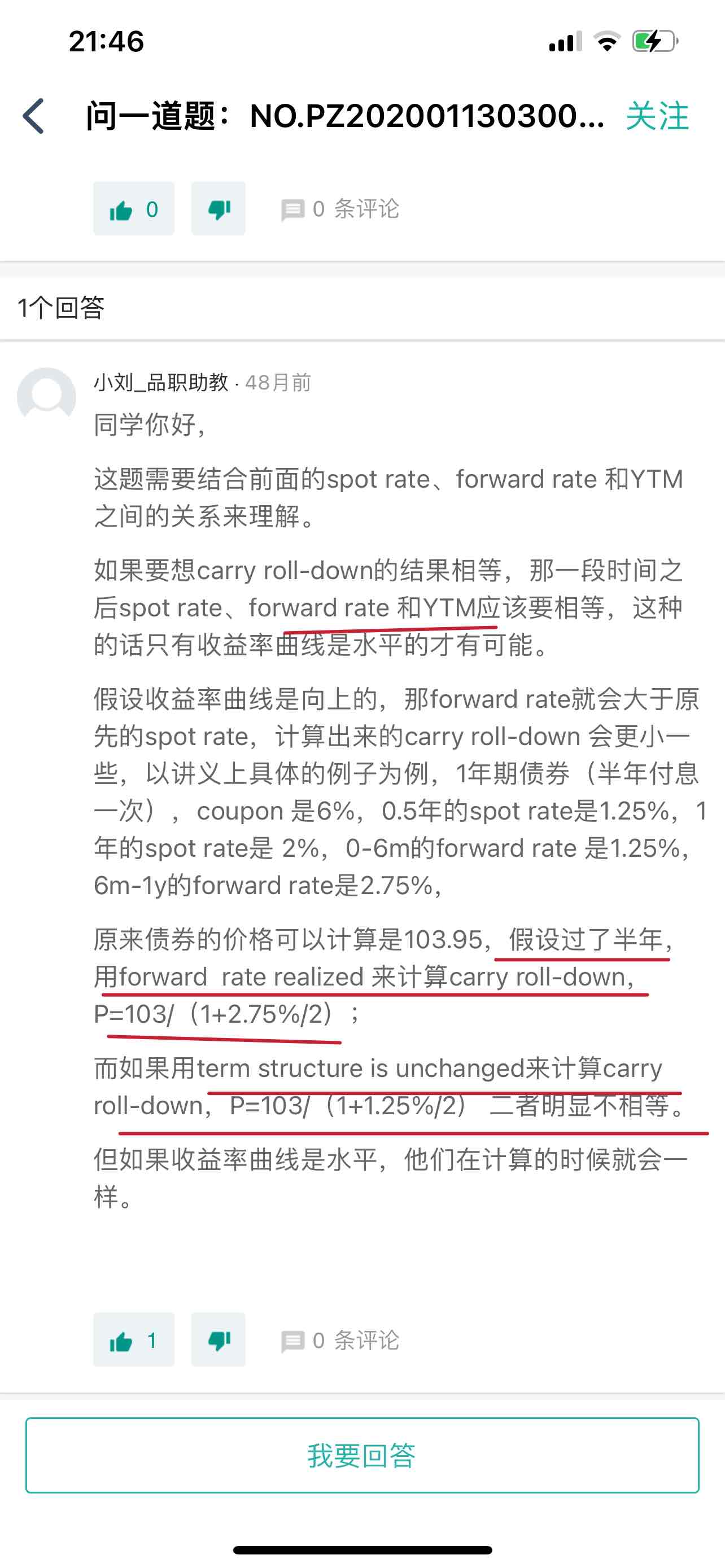

老师好,看了您对别的同学的回答,有几个问题,1、YTM和spot rate有关系,是各期限spot rate的打包价,YTM和forward rate没关系吧?

2、PV=103.95,carry roll down 在仅考虑时间变化的公式是BVt(R’t,St-1)-BVt-1(Rt-1,St-1),不明白103/(1+2.75%/2)是啥意思啊?第三条红线也是,为什么term structure unchanged,carry roll down是103/(1+1.25%/2)?这两个103都是0时刻的PV,103.95?