NO.PZ2022122801000008

问题如下:

A few months later, Carson

receives a phone call from Hamidah. She’s now on the board of trustees of Artic

Foundation for Medical Research (AFMR). AFMR was established to support various

medical research initiatives. She is very excited and asks Carson to help

identify the return objective of AFMR’s portfolio. Osaka notes the following:

• AFMR’s overall

investment objective is to maintain its portfolio’s real purchasing power after

distributions.

• The risk-free

rate is 4.0%.

• An expected

inflation rate is 3.5%.

• The portfolio’s

standard deviation is 15.0%.

• The cost of

earnings investment returns is 50 bp.

• AFMR targets a

5.5% annual distribution of assets.

AFMR’s return objective is closest to: (2020 mock PM)

选项:

A. 9.50%

9.74%

10.27%

解释:

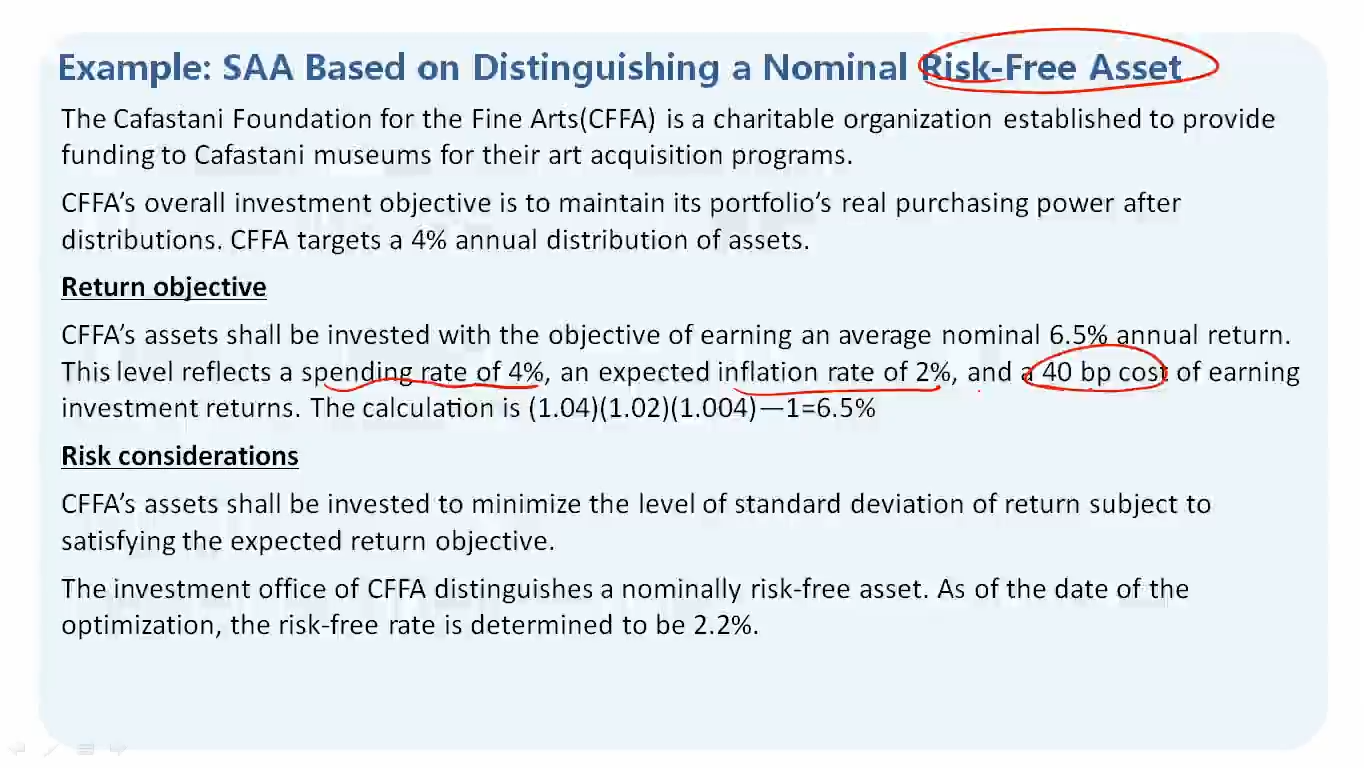

The calculation is (1.055) (1.035) (1.005) – 1 = 9.74%.

AFMR’s assets should be invested with the objective of earning a nominal average annual return of 9.74%. This level reflects a spending rate of 5.5%, an expected inflation rate of 3.5% and a 50 bp cost of earning investment returns.

- 请问老师,这道题会涉及geometric return v.s arithmetic return 的考点吗?

- geometric return v.s arithmetic return 的知识点是哪个章节的哪个module的呢?想不起来了,一下子没有找到~