NO.PZ202208300100000103

问题如下:

Bardem Case Scenario

Javier Casado, an analyst who manages funds for high-net-worth investors, is evaluating Bardem S.A. (Bardem) as a possible addition to a large investment portfolio. Bardem, based in Madrid, Spain, is a manufacturing firm that specializes in packaging materials. The company reports using IFRS, and its reporting currency is the Euro.

Casado learns that Bardem acquired a 25% stake in Ariana Shipping S.A. (Ariana) on 1 January 2020. Ariana, which is based in Greece, has bought packaging supplies from Bardem in the past based on catalog prices. Casado believes that the purchase will change the relationship between the two companies and will also affect Bardem’s financial reporting. He mentions to a coworker, Ana Domingues, that the price paid by Bardem for the Ariana shares was €80 million.

Domingues tells Casado that Bardem’s purchase of Ariana’s equity will likely allow Bardem to influence Ariana’s financial and operating performance. As a result, she states, Bardem will be required to use the equity method of accounting for this investment. Casado replies that the equity method of accounting is only required under IFRS for joint ventures or when the investee holds a seat on the associate’s board of directors.

Bardem prepares the following table to examine the purchase more closely.

Exhibit 1

Book Values and Fair Values of Ariana Shipping Assets and Liabilities as of 31 December 2019 (€ millions)

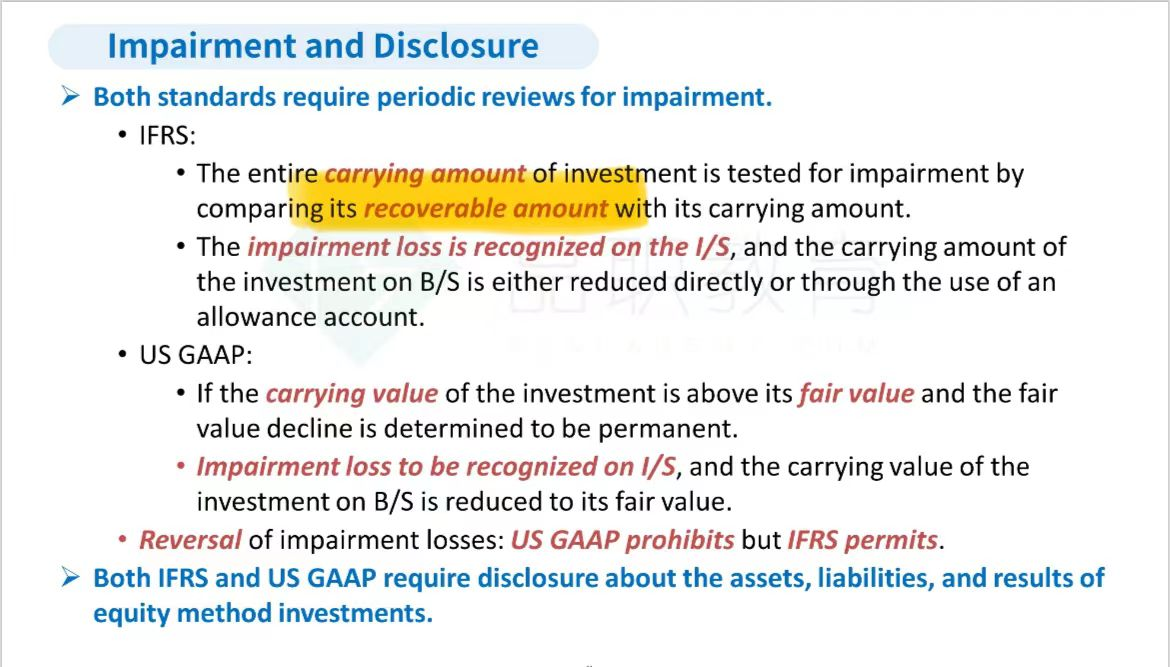

Domingues says that she is concerned that Bardem didn’t sufficiently investigate Ariana before the purchase, given economic uncertainty surrounding Greek companies. She asks Casado what will happen to Bardem’s financial statements if the value of Ariana is permanently impaired due to business losses or other demonstrable events. Casado replies that if the equity method is not required, then there will be no impact. However, if the equity method is used, he states:

Goodwill must be separately tested for impairment.

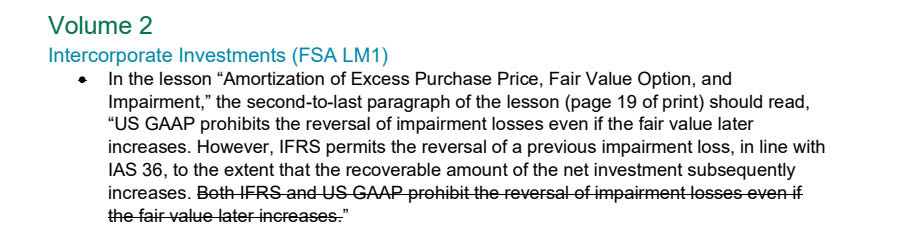

US GAAP prohibits the reversal of impairment losses but IFRS permits.

Impairment losses exceeding the goodwill value are allocated pro-rata to the unit’s non-cash assets.

Domingues informs Casado of a final piece of information relevant to his evaluation. To increase liquidity, Bardem is considering borrowing €70M against accounts receivable. As an alternative to borrowing, they could securitize the receivables by creating a special purpose entity (SPE) over which they would exercise control. To do so, they would invest €5M in the SPE. The SPE would then borrow €70M, and would buy €75M in receivables from Bardem. Domingues comments that securitization using an SPE would impact Bardem’s reported financial condition in three ways. It would:

reduce the cost of borrowing.

increase the level of current assets.

improve balance sheet ratios.

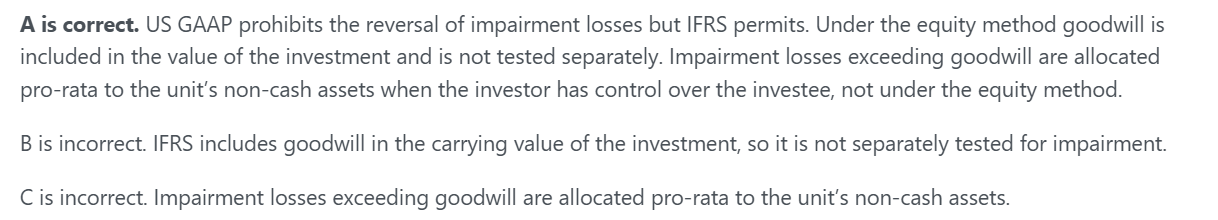

Which of Casado’s three statements regarding the potential impairment of the investment in Ariana is most accurate? Statement:

选项:

A.2 B.1 C.3解释:

Solution

A is correct. US GAAP prohibits the reversal of impairment losses but IFRS permits. Under the equity method goodwill is included in the value of the investment and is not tested separately. Impairment losses exceeding goodwill are allocated pro-rata to the unit’s non-cash assets when the investor has control over the investee, not under the equity method.

B is incorrect. IFRS includes goodwill in the carrying value of the investment, so it is not separately tested for impairment.

C is incorrect. Impairment losses exceeding goodwill are allocated pro-rata to the unit’s non-cash assets.

C中的表述和3的表述不是一样的吗?

另外:Both IFRS and US GAAP prohibit the reversal of impairment losses recognized using the equity method, even if the fair value later increases