NO.PZ202110280100000702

问题如下:

Identify the type of error Connell is at risk of committing and its associated cost for each alternative. Justify your selection.

选项:

解释:

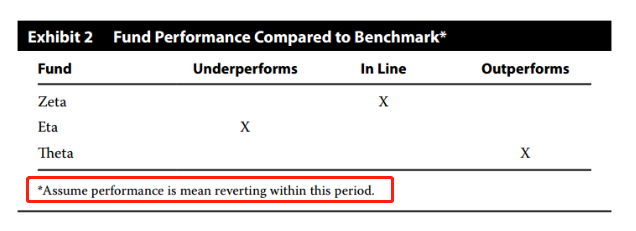

Alternative 1

If Connell avoids the Eta fund because of its recent underperformance, with performance reverting to the mean, he is at risk of making a Type II error (by not retaining managers with skill). A Type II error is an error of omission or inaction, or in this case, the opportunity cost associated with not hiring Eta and seeing its performance improve.

Alternative 2

If Connell selects the Theta fund because of its recent superior performance, with performance reverting to the mean, he is at risk of making a Type I error. A Type I error occurs when hiring or retaining a manager who subsequently underperforms expectations. The cost of a Type I error is explicit and relatively straightforward to measure.

In deciding which fund to hire, the goal is to avoid making decisions based on short-term performance (trend following) and to identify evidence of behavioral biases in the evaluation of managers during the selection process.

感觉这个题目的思路很奇怪,可以仔细的解释一下考点吗?