NO.PZ2018103102000055

问题如下:

Jacques is conducting an analysis of H&M, a publicly traded European retail distributor of products for home decoration. The home decoration is cyclical. Although sales and earnings at H&M weakened, same store sales are beginning to improve as consumers undertake more home improvement projects. Poor performing stores were closed, resulting in significant restructuring charges in 2017. Based on the given information, the most appropriate valuation ratio for H&M is?

选项:

A.Price-to-book (P/B) ratio

B.Price-to-earnings (P/E) ratio using trailing earnings

C.Price-to-earnings ratio using normalized earnings

解释:

C is correct.

考点:PE

解析:C是正确的。H&M是周期性行业,使用标准化后的收益可以平滑其盈利周期性波动问题。

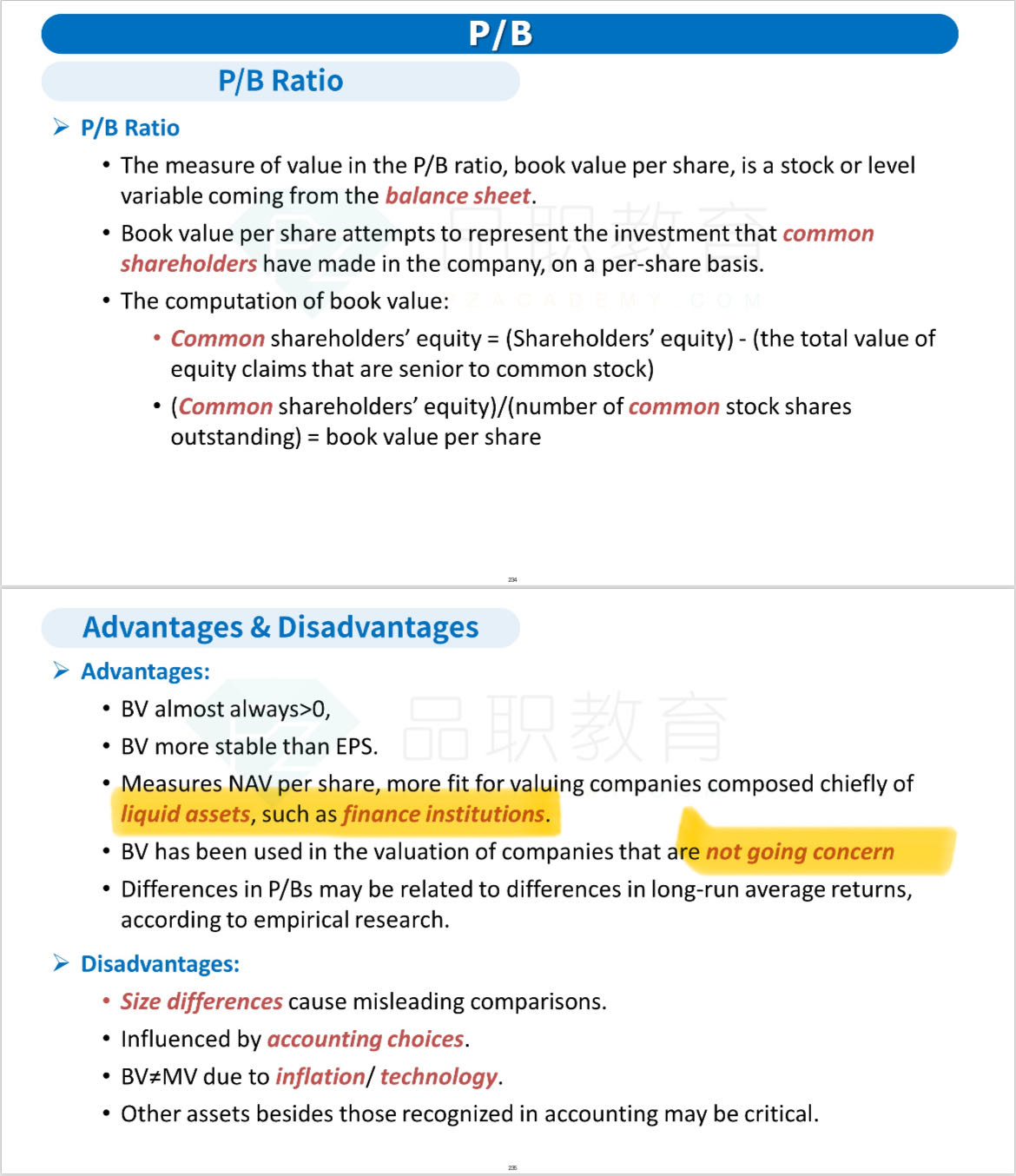

以及什么情况下需要用P/B ratio?要破产清算的时候吗?