NO.PZ202209060200004204

问题如下:

In Larent’s discussion about the top-down approach to portfolio construction, she is most likely correct about:

选项:

A.assessing the impact of yield curve reshaping.

B.maturity weighting related to a change in spread curve.

C.the allocation of lower-quality bonds in a credit portfolio.

解释:

SolutionC is correct. Larent’s comment about credit portfolios that are overweight lower-quality bonds likely outperforming a global benchmark whenever global economic conditions improve is correct.

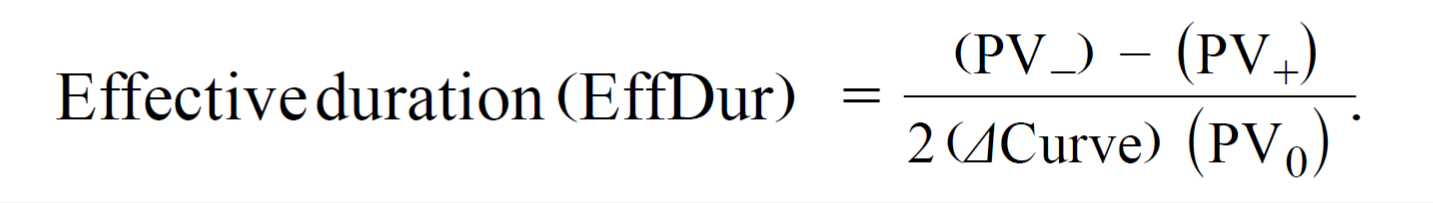

A is incorrect. Effective duration is used to measure the impact of a parallel change in the yield curve, not a steepening in the yield curve.

B is incorrect. With respect to the spread curve, overweighting shorter-maturity bonds and underweighting longer-maturity bonds is not optimal whenever there is an expectation that a relatively wide spread curve will flatten. When a wide spread curve flattens, the yields of longer-maturity bonds decline by a magnitude that is greater than the magnitude of changes (up or down) in the yields of shorter-maturity bonds. Accordingly, the optimal portfolio construction strategy is to be underweight shorter-maturity bonds and overweight longer-maturity bonds.

effective duration不是P1-Po/y吗?事后和事前,含option都可以,为啥现在情况不可以。这题正确说法是不是empirical duration,谢谢老师