NO.PZ202112010200000702

问题如下:

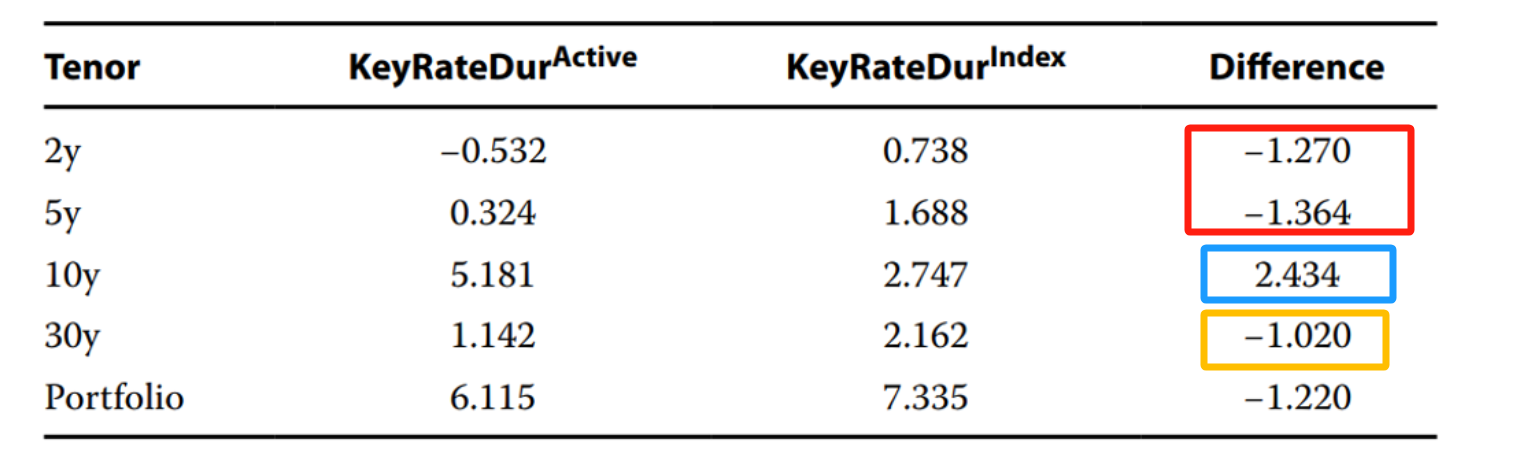

A financial analyst at an in-house asset manager fund has created the following spreadsheet of key rate durations to compare her active position to that of a benchmark index so she can compare the rate sensitivities across maturities.

Which of the following statements best characterizes how the active portfolio is positioned for yield curve changes relative to the index portfolio?

选项:

A.The active portfolio is

positioned to benefit from a bear steepening of the yield curve versus the

benchmark portfolio.

The active portfolio is positioned to benefit from a positive butterfly movement in the shape of the yield curve versus the index.

The active portfolio is positioned to benefit from yield curve flattening versus the index.

解释:

B is correct. A positive butterfly indicates a decrease in the butterfly spread due to an expected rise in short- and long-term yields-to-maturity combined with a lower medium-term yield-to-maturity.

Since the active portfolio is short duration versus the index in the 2-year, 5-year, and 30-year maturities and long duration in the 10-year, it will generate excess return if the butterfly spread falls.

- 题目中出现的10年bond 属于中期还是长期?

- A选项和C分别错在哪里呢? C中说的flatten我们是不是需要考虑两种情况的flatten ?