NO.PZ2023091901000102

问题如下:

A portfolio manager at an investment management firm is developing a new portfolio strategy which incorporates various asset classes. The manager considers using both the arbitrage pricing theory (APT) model and the capital asset pricing model (CAPM) to analyze both the systematic and specific risks with these assets. Which of the following statements will the manager find to be correct about the given theory?

选项:

A.The CAPM assumes that all investors will make identical assumptions on the volatility and expected return of all available assets.

B.The APT describes an asset’s return as having a nonlinear relationship with several market factors. C.The APT assumes that investors are risk averse, while the CAPM does not. D.Neither the APT nor the CAPM captures idiosyncratic risk that is not reflected in a factor exposure.解释:

A is correct. CAPM assumes that all market participants have the same expectations and make their investment decisions based on the mean and variance of returns.

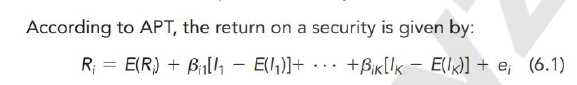

B is incorrect. According to the APT, an asset’s expected rate of return is a linear function of several factors.

C is incorrect. The CAPM assumes investors are risk averse and only invest based on the mean and variance of returns. The APT relaxes that assumption.

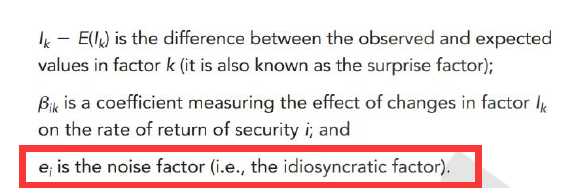

D is incorrect. The

APT includes a noise factor for idiosyncratic risk.

A正确。CAPM假设所有市场参与者都有相同的期望,并根据收益的均值和方差做出投资决策。

B不正确。根据APT,资产的预期收益率是几个因素的线性函数。

C选项不正确。CAPM假设投资者是风险厌恶者,只根据收益的均值和方差进行投资。而APT放松了这种假设。

D选项不正确。APT包含一个特殊风险的噪声因子。

请问老师,D选项怎么理解