NO.PZ202304070100007402

问题如下:

All else being equal, if the shape of the yield curve changes from upward sloping to flattening, the value of the option embedded in Bond #2 will most likely:

选项:

A.decrease.

remain unchanged.

increase.

解释:

Correct Answer: C

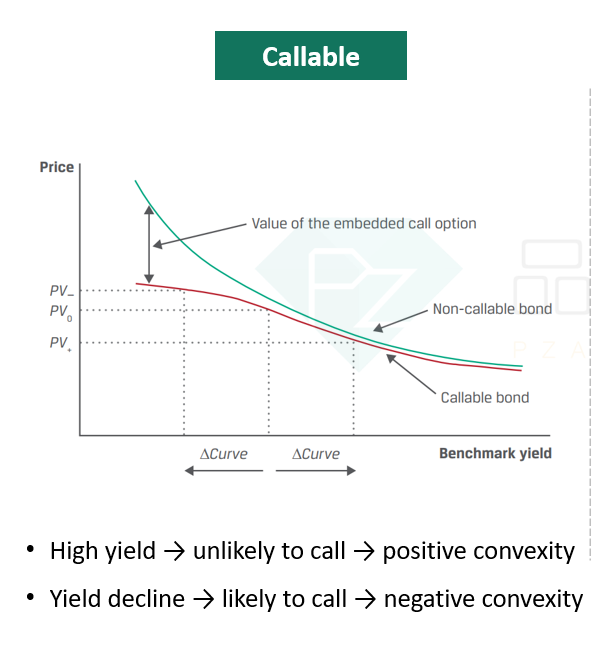

Bond #2 is a callable bond, and the value of the embedded call option increases as the yield curve flattens. When the yield curve is upward sloping, the one-period forward rates on the interest rate tree are high and opportunities for the issuer to call the bond are fewer. When the yield curve flattens or inverts, many nodes on the tree have lower forward rates, which increases the opportunities to call and, thus, the value of the embedded call option.

用公式 Vcallable = Vstraight - Vcall

利率下降,price increase,更容易行權,Vcall 不是會上升嗎?接著Vcallable會下降?