NO.PZ2023040501000013

问题如下:

Dagmar AG is a European-based manufacturing firm that prepares its financial statements according to International Financial Reporting Standards (IFRS). Two members of Dagmar’s treasury group, Henrik Ferdinand and Adele Christoph, are reviewing Dagmar’s portfolio of investments.

Turning to the issue of impairment, Christoph says:

“I believe the decline in the share price of Elbe is related to its weak product offering. However the market is also unsettled by the uncertainty surrounding the current status of Elbe’s defined benefit pension plan.”

Furthermore, Christoph states:“I think we should consider the investment in Elbe impaired because with the decline in the share price, the market value has recently fallen below our book value.”

Ferdinand responds:“I do not think we have to consider it impaired because

1. despite the pension plan problems, Elbe has been able to maintain its dividends at their historical rate; and

2. the remaining goodwill from the acquisition has not been fully written off.”

Which of the statements concerning whether the investment in Elbe should be considered impaired as at the end of 2017 is most appropriate? The statement made by:

选项:

A.

Ferdinand about the dividends.

B.

Ferdinand about the remaining goodwill.

C.

Christoph about market value.

解释:

A is correct. Under IFRS, there must be objective evidence of impairment as a result of one or more events after the initial recognition that have an effect on the investment’s future cash flows and that can be reliably measured. Ferdinand is correct in his statement that Elbe has been able to maintain dividend payments. Current dividends are €0.50 on earnings per share of €12,373/6,000 = €2.06, for a payout ratio of 24%, implying that cash flows do not appear to be impaired. Therefore, the investment should not be considered impaired for that reason.

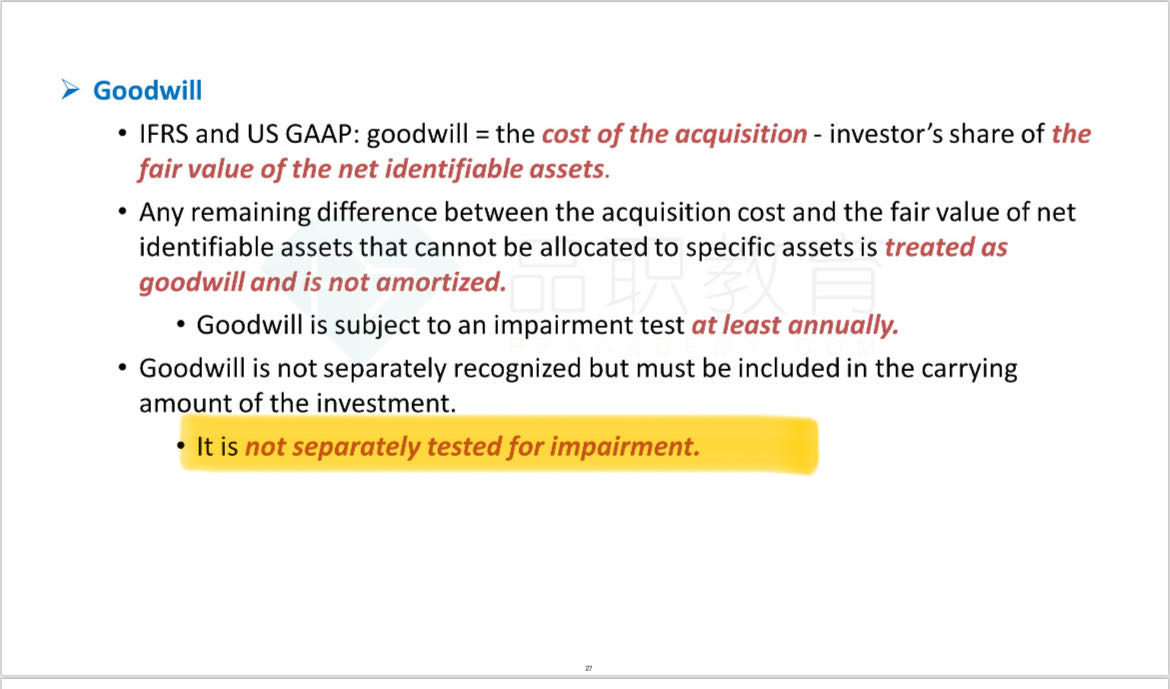

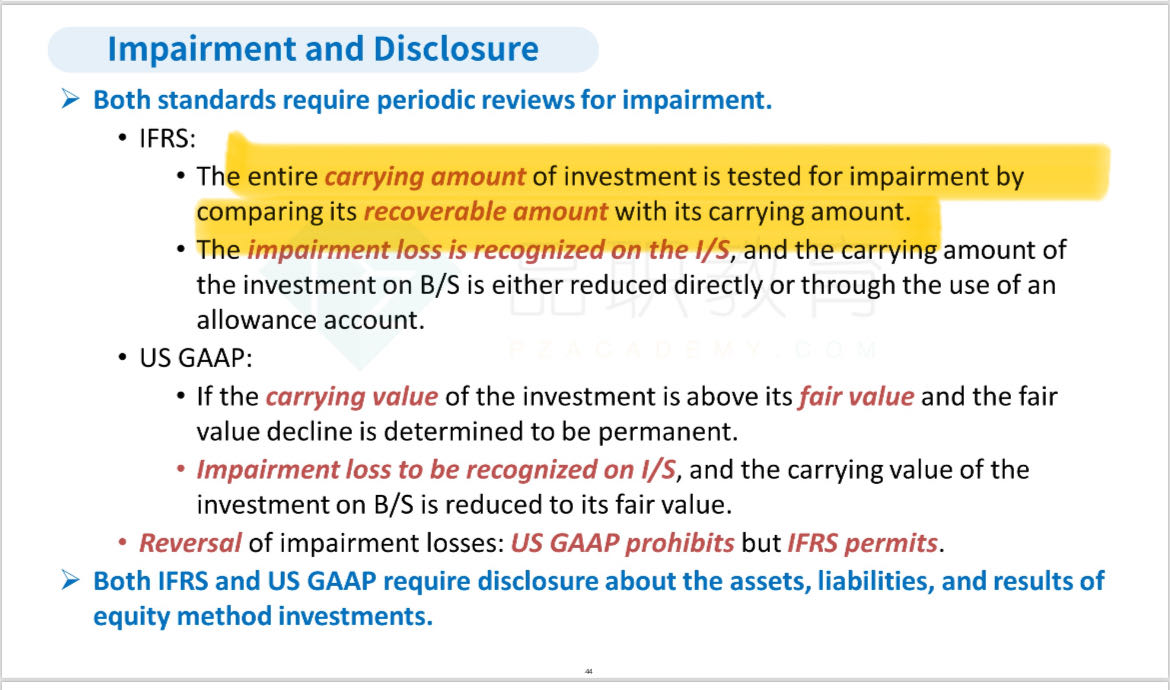

If the investment’s fair market value is below its carrying (book) value and the decline is deemed other than temporary, an impairment loss must be recognized. According to Christoph, however, the market value “has just recently fallen” below the book value, and there is no indication that the situation of fair value below carrying value is other than temporary. Under the equity method, the investment is not carried at market value. Goodwill is not tested separately for impairment for investments using the equity method.

B is incorrect because under IFRS the goodwill is not tested separately from the investment as it is with investments being accounted for by consolidation.

C is incorrect because the fact that book value is greater than share value alone is not evidence of impairment.

老师,bc选项为什么错?知识点在哪