NO.PZ202207040100000806

问题如下:

The Epsilon Institute Case Scenario

The Epsilon Institute of Theoretical Physics is a non-profit corporation initially funded from government and private sources. Mitch Lazare is the chairman of the Investment Committee, which oversees the institute’s endowment fund, of which about $750 million is currently under active management. He is currently tasked with finding two additional investment managers to manage a portion of the actively managed funds and, along with his assistant, Brian Warrack, is reviewing the presentations made by several applicants.

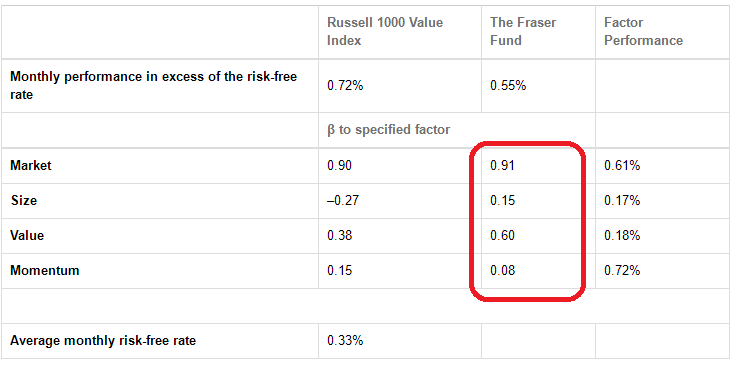

John Fraser’s performance is the first that Lazare and Warrack review. Fraser’s fund is constructed with a discretionary approach using the four Fama–French factors; he uses the Russell 1000 Value Index as his benchmark. The most recent 10 years of performance data for both the fund and the benchmark are shown in Exhibit 1.

Exhibit 1

Fraser Fund and Benchmark Average Monthly Performance over the Past 10 years

As part of his evaluation of the applicants, Warrack compiles a record of the Active Share and active risk of the funds that they manage. He observes that the Mattley Fund has relatively high Active Share but relatively low active risk.

Lazare and Warrack make the following comments about Active Share and active risk in the context of a single-factor model:

The level of active risk will rise with an increase in idiosyncratic volatility.

The active risk attributed to Active Share will be smaller in more diversified portfolios.

If the factor exposure is fully neutralized, the Active Share will be entirely attributed to the active risk.

The manager of the Western Fund focuses on smaller companies in the Russell 1000 Value Index and uses the following constraints:

Size: The capitalization of the average company is $1.8 billion. On average, companies of this size trade 0.90% of their capitalization every day.

Liquidity: Positions can be no larger than 7% of average daily trading volume.

Allocation: Positions can be no larger than 1.75% of total assets under management.

Diversification: The portfolio must contain at least 60 securities.

If the manager of the Western Fund is hired by Epsilon, she will have $100 million of Epsilon’s funds to manage.

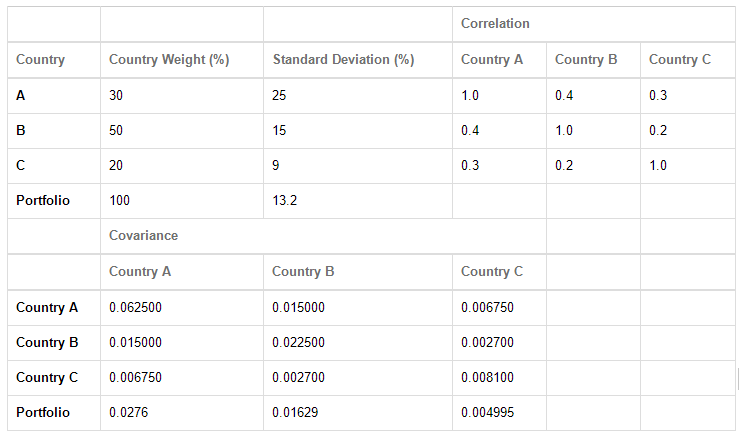

Lazare and Warrack turn their attention to the manager of the Herrick Fund, which is the only fund that involves substantial international exposure. Lazare believes that current political events in Country A may result in greater risk exposure than might be appropriate and wishes to investigate further.

The Herrick Fund manager provides them with the information in Exhibit 2, which they use to carry out a risk attribution analysis.

Exhibit 2

The Herrick Fund—Risk Analysis

The investment process indicated for the Fraser Fund is most likely designed around which of the following?

选项:

A.A balanced exposure to known rewarded factors

Research-based rules across a broad universe of securities

The inclusion of non-financial variables, such as pricing power

解释:

C is correct. The discretionary investment process searches for active returns from firm-specific factors, such as pricing power and the competitive landscape. This process results in more concentrated portfolios reflecting the depth of the manager’s insights on firm characteristics and the competitive landscape. A systematic investment approach is likely to be designed around extracting premiums from a balanced exposure to known, rewarded factors and typically incorporates research-based rules across a broad universe of securities.

A is incorrect. A systematic investment approach is likely to be designed around extracting premiums from a balanced exposure to known, rewarded factors, whereas a discretionary approach usually searches for active return from firm-specific factors.

B is incorrect. A systematic investment approach is likely to be designed around research-based rules across a broad universe of securities, whereas a discretionary approach will involve managerial judgments on a smaller subset of securities.

1.是不是主观和量化都可以用factor,区别在于,主观投资的因子用的少,或者主要是某个公司某只股票的单独的因子?量化就是rewarding factor ?

2.表格里只用了四个因子,所以不会是量化投资,因为如果是量化投资,因子会使用的更多?

所以A选择是错的?