NO.PZ201712110200000306

问题如下:

John Smith, an investment adviser, meets with Lydia Carter to discuss her pending retirement and potential changes to her investment portfolio. Domestic economic activity has been weakening recently, and Smith’s outlook is that equity market values will be lower during the next year. He would like Carter to consider reducing her equity exposure in favor of adding more fixed-income securities to the portfolio.

Government yields have remained low for an extended period, and Smith suggests considering investment-grade corporate bonds to provide additional yield above government debt issues. In light of recent poor employment figures and two consecutive quarters of negative GDP growth, the consensus forecast among economists is that the central bank, at its next meeting this month, will take actions that will lead to lower interest rates.

Smith and Carter review par, spot, and one-year forward rates (Exhibit 1) and four fixed-rate investment-grade bonds issued by Alpha Corporation which are being considered for investment (Exhibit 2).

Exhibit 1.₤Par, Spot, and One-Year Forward Rates (annual coupon payments)

Exhibit 2.₤Selected Fixed-Rate Bonds of Alpha Corporation

Note: All bonds in Exhibit 2 have remaining maturities of exactly three years

Carter tells Smith that the local news media have been reporting that housing starts, exports, and demand for consumer credit are all relatively strong, even in light of other poor macroeconomic indicators. Smith explains that the divergence in economic data leads him to believe that volatility in interest rates will increase. Smith also states that he recently read a report issued by Brown and Company forecasting that the yield curve could invert within the next six months.

Smith develops a binomial interest rate tree with a 15% interest rate volatility assumption to assess the value of Alpha Corporation’s bonds. Exhibit 3 presents the interest rate tree.

Exhibit 3.₤Binomial Interest Rate Tree for Alpha Corporation 15% Interest Rate Volatility

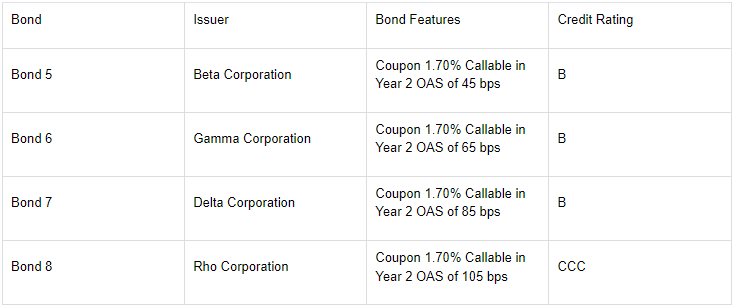

Carter asks Smith about the possibility of analyzing bonds that have lower credit ratings than the investment-grade Alpha bonds. Smith discusses four other corporate bonds with Carter. Exhibit 4 presents selected data on the four bonds.

Exhibit 4.₤Selected Information on Fixed-Rate Bonds for Beta, Gamma, Delta, and Rho Corporations

Notes: All bonds have remaining maturities of three years. OAS stands for option-adjusted spread.

If the Brown and Company forecast comes true, which of the following is most likely to occur? The value of the embedded option in:

选项:

A.Bond 3 decreases.

B.Bond 4 decreases.

C.both Bond 3 and Bond 4 increases.

解释:

A is correct.

All else being equal, the value of a put option decreases as the yield curve moves from being upward sloping to flat to downward sloping (inverted). Alternatively, a call option’s value increases as the yield curve flattens and increases further if the yield curve inverts. Therefore, if the yield curve became inverted, the value of the embedded option in Bond 3 (putable) would decrease and the value of the embedded option in Bond 4 (Callable) would increase.

Smith explains that the divergence in economic data leads him to believe that volatility in interest rates will increase.

因为volatility上升,所以Option Value上升,选了C,leads him to believe我觉得就是他的预测呀