NO.PZ2020021205000016

问题如下:

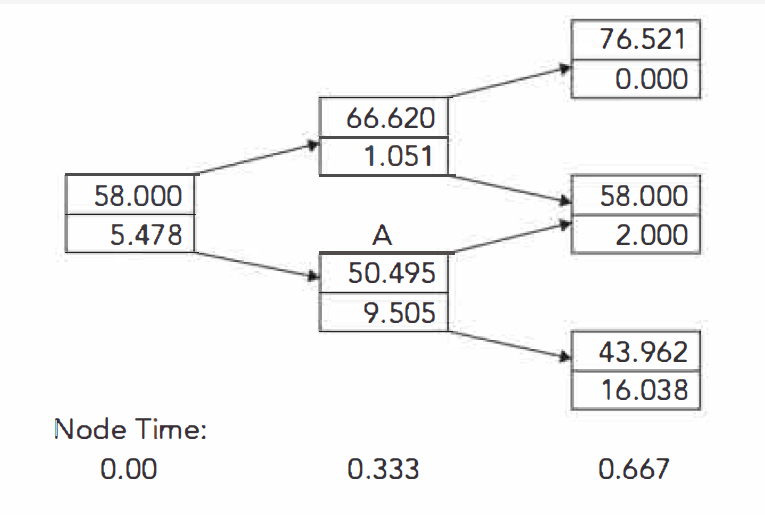

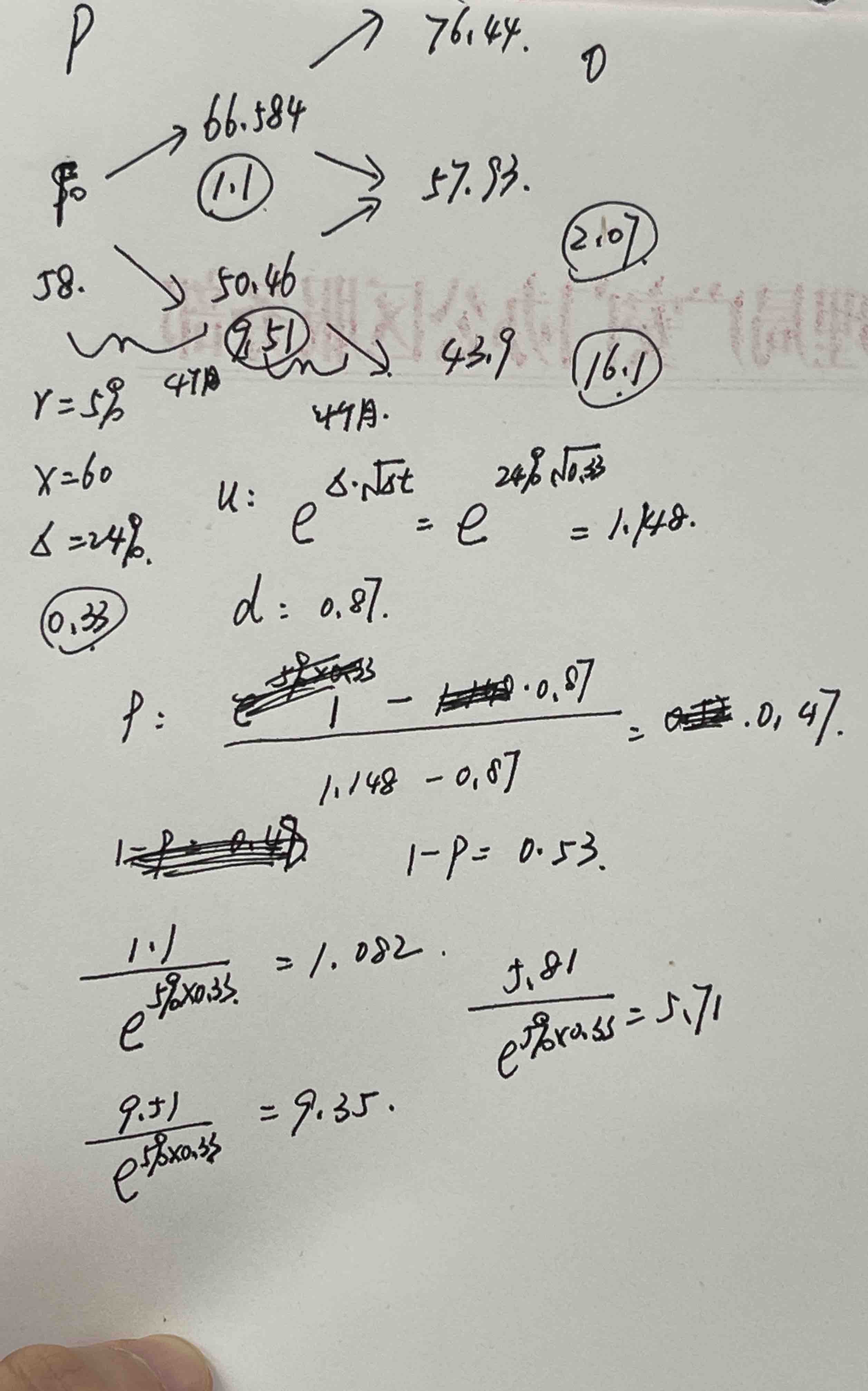

Use a two-step tree to value an eight-month American put option on a futures contract. The current futures price is 58 and the risk-free rate is 5%. The strike price is 60 and the volatility is 24% per annum.

解释:

The option is exercised at node A. The value today is 5.478

老师好,我的计算过程哪里算错了吗?又和答案对不上