NO.PZ2018101901000024

问题如下:

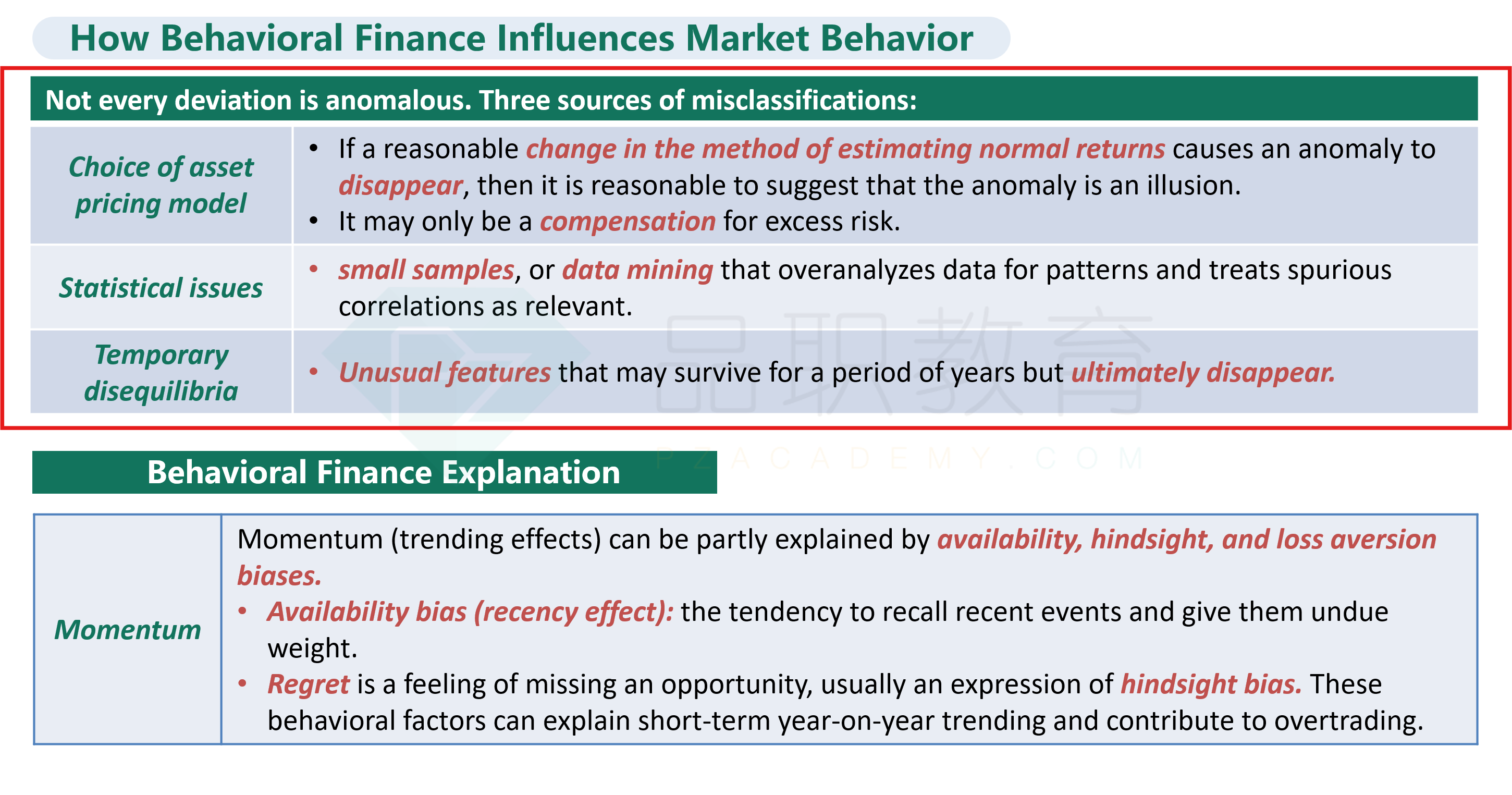

All of the following are reasons that the historical outperformance of value stocks versus growth stocks may not be anomalous except:

选项:

A.Abnormal returns represent compensation for risk exposures, such as the heightened risk of value stocks to suffer distress during downturns.

B.Companies with strong historical growth rates are viewed as good investments, with higher expected returns than risk characteristics merit.

C.The deviation disappears by incorporating a three-factor asset pricing model.

解释:

B is correct.

This choice describes the halo effect, which does offer a behavioral explanation for the poor performance of growth stocks versus value stocks. Growth stocks are mispriced relative to their risk characteristics, because FMPs focusing on just a few properties, such as a high historical revenue growth rate, while neglecting other characteristics.

B选项历史表现有较快增长率的公司就被视为良好的投资,预期回报高于风险特征。这其实说的是光环效应(halo effect),FMPs容易只关注他的增长率而不考虑其他的因素,导致成长性的股票被高估。

被高估的话,return不就低吗,为什么行为心理学的原因就不是原因呢?