NO.PZ2018091701000038

问题如下:

Analysts collected some market data to find maximum Sharpe ratio of manager, based on his analysis, market’s expected annual return is 7%, return standard deviation is 24%, Sharpe ratio is 0.41. Universe fund has active return 6% and active risk 12%. Please calculate the maximum Sharpe ratio:

选项:

A.

0.33

B.

0.65

C.

0.42

解释:

B is correct.

考点:考察公式 SR2p=SR2B+IR2

解析:第一步我们需要先根据已知条件计算出基金的information ratio: IR=6%/12%=0.5

第二步代入公式:

SR2p=SR2B+IR2=0.412+0.52=0.42

第三步开根号0.42得到0.65

之前的解释拷贝如下:

①Rb-Rf≠7%,根据SRb=0.41和σb=24%可以得到Rb-Rf=9.84%

②SRp分子的计算方式是由于IR=0.5,所以代入optimal active risk即σA后得到active return(即Rp-Rb)=14.635%。所以Rp-Rb=14.635%+9.84%=24.475%

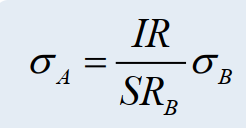

③SRp的分母不是σA,σA是optimal active risk,并不是σp,σp的算法为根号下 σb的平方+σA的平方,最后算出来应该是37.85%

所以这种方法最后算出来的SRp=24.475%/37.85%=0.6466。和答案一致

请问σA等于0.2927如何得到的?我算不出来