NO.PZ2021090804000014

问题如下:

Ann is a rich woman. She wants to transfer part of her wealth to her son and nephew , but she is not sure whether she should use lifetime gifts or testamentary bequests. So she consulted her wealth adviser Johnson. The present value of the amount she wants to transfer to each of them is $1,000,000.

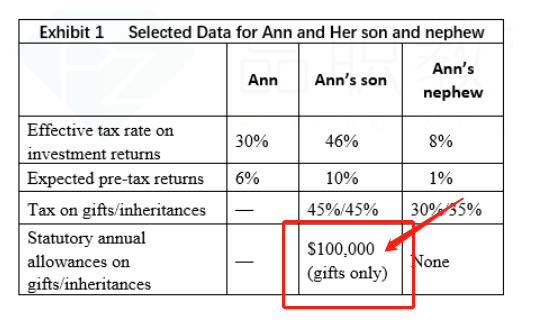

Ann's son has a high income and is an aggressive and successful investor. In contrast, Ann's nephew has a low income and has minimal interest in investment. The selected data for Ann and his sons and nephew are shown in Exhibit 1.

Ann asked Johnson to advise him on the most tax-efficient method for each transfer of wealth. In the analysis, Johnson assumes that the gift (if selected) would happen within ten years.

Recommend the most tax-efficient wealth transfer option (lifetime gift or testamentary bequest) for Ann's son and nephew . Show your calculations.

选项:

解释:

The formula for the relative after-tax value a lifetime gift compared to a testamentary bequest is:

Ann’s son’s wealth transfer, making a lifetime gift are more tax-efficient than a testamentary bequest.

Prior to the application of gift tax, Ann's son has an annual exclusion of $100,000 . Since the gift is $1,000,000, which is exactly the value of the exclusion, she would not pay the gift tax. The relative value of the transfer of Ann's son is

Therefore, for Ann’s son’s wealth transfer, making a lifetime gift are more tax-efficient than a testamentary bequest. The transfer of $100,000 now would retain more than twice the wealth in 10 years as the inheritance transferred in 10 years. As shown above, even if the investment income tax paid by her son (46%) is higher than that of Ann (30%), the gift would allow Ann's son 103.88% more wealth than through a bequest. The reasons for the higher tax efficiency of the gift are that (1) the son expects a higher return on investment (10%) than Ann (6%) and (2) gift will not incur a transfer tax, while a bequest would incur a transfer tax of 45% .

在申请赠与税之前,Ann 的儿子每年有 100,000 美元的免税额。转移支付10年完成, 由于lifetime gift是 1,000,000 美元,这刚好等于免税额度的价值,她不会支付赠与税。 安儿子转让的相对价值为2.0388

因此,对于安儿子的财富转移而言,lifetime gift比遗嘱遗赠更节税。 现在转移 100,000 美元将在 10 年内保留的财富是 10 年转移的遗产的两倍多。 即使她儿子支付的投资所得税(46%)高于安(30%),lifetime gift也能让安的儿子比通过遗赠多获得103.87%的财富。 赠与的税收效率较高的原因

(1)儿子期望的投资回报(10%)高于安(6%)

(2)赠与不会产生转让税,而遗赠则会产生 45%的转让税。

For the wealth transfer to Ann’s nephew,, a testamentary bequest is more tax efficient than making a lifetime gift.

The nephew has no annual exclusion, so she would have to pay transfer tax for the gift or inheritance. The relative value of transfers for Ann’s nephew is

For the wealth transfer to Ann’s nephew,, a testamentary bequest is more tax efficient than making a lifetime gift. As shown in the above formula, after 10 years, the wealth from the gift transfer would only be 78.21% of the wealth the nephew would bet from a bequest in 10 years. Even if the investment income tax paid by the nephew (8%) is much lower than that paid by Ann (30%) and the applicable gift tax (30%) is lower than the inheritance tax (35%). The reason for the superior tax efficiency of the bequest is that Ann's expected return on investment (6%) is higher than his nephew's expectation (1%).

对于将财富转移给 Ann 的侄子,遗嘱遗赠比赠送lifetime gift更具税收效率。

侄子没有年度豁免,因此她必须为lifetime gift或继承支付转让税。 Ann 的侄子转移的相对价值是0.7821

对于将财富转移给 Ann 的侄子,遗嘱遗赠比lifetime gift更具税收效率。 如上式所示,10年后,赠与转让的财富仅为侄子10年后下注的遗产财富的78.21%。 即使侄子支付的投资所得税(8%)远低于安支付的投资所得税(30%),适用的赠与税(30%)低于遗产税(35%)。 遗产的税收效率优越的原因是安的预期投资回报率(6%)高于他侄子的预期(1%)。

可以指出题中那里表明每年gifting $100,000 这一条件么?

为什么不是在起初一次性给$1,000,000?

谢谢