NO.PZ201512300100000806

问题如下:

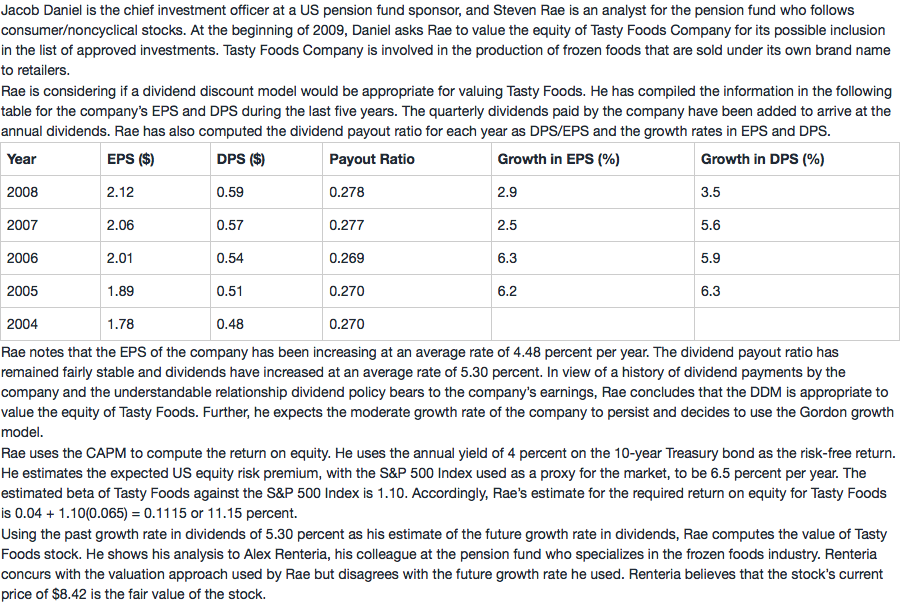

6. If Alex Renteria is correct that the current price of Tasty Foods stock is its fair value, what is expected capital gains yield on the stock?

选项:

A.3.87%.

B.4.25%.

C.5.30%.

解释:

A is correct.

If the stock is fairly priced in the market as per the Gordon growth model, the stock price is expected to increase at g, the expected growth rate in dividends. The implied growth rate in dividends, if price is the fair value, is 3.87 percent. Therefore, the expected capital gains yield is 3.87 percent.

有一道题的解析里面是这么说的:Total return = Dividend yield + Capital gains yield。total return不就是required return么?