NO.PZ2024021803000005

问题如下:

Call price: $10,Stock price: $40,Exercise price: $60 Interest rate: 3%,Time to expiry: 1 year.Based on the put-call parity, what is the estimated price of the put option?选项:

A.$28.25 B.$30.00 C.$108.25解释:

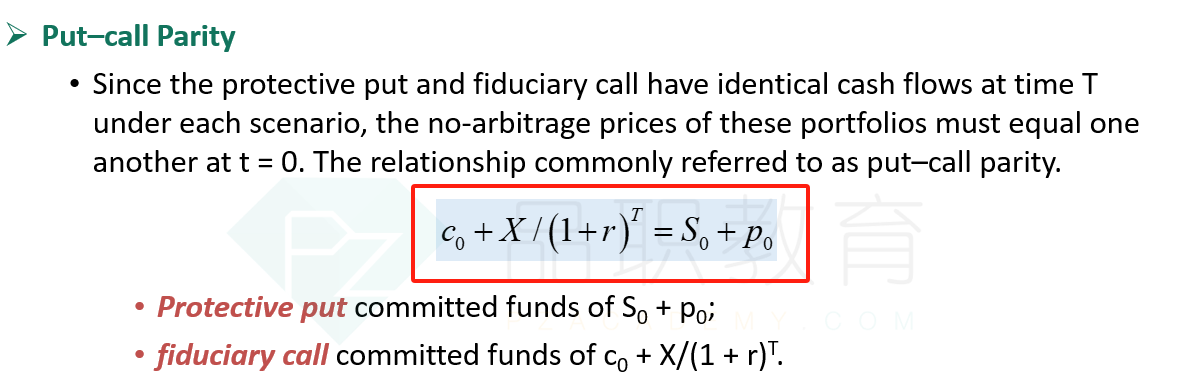

Put-call parity provides a mathematical relationship between the prices of European put and call options. 根据看涨看跌平价理论,可以计算出欧式看跌期权的估计价格请问 这里 exercise price 60 需要 60 / (1 + 3%) --> i.e.需要折现 是因为 exercie price 是 T 时间点的价格, 而 其他题目给的 (C & S)都是 零时间点的价格, 所以没有必要折现 - 这样理解对吗?

我选了 B - 正确答案是A - 可以得到答案A的似乎只有 当exercie price 折现

谢谢!