NO.PZ2023103101000062

问题如下:

Buyout Capital, LLC, is a private equity fund that has the following characteristics:

Capital committed: $200 million

Preferred return: 8% soft hurdle

Fund distribution: after five years

Management fee: none

Carried interest: 20% above preferred return

Waterfall structure: American (deal by deal) with clawback

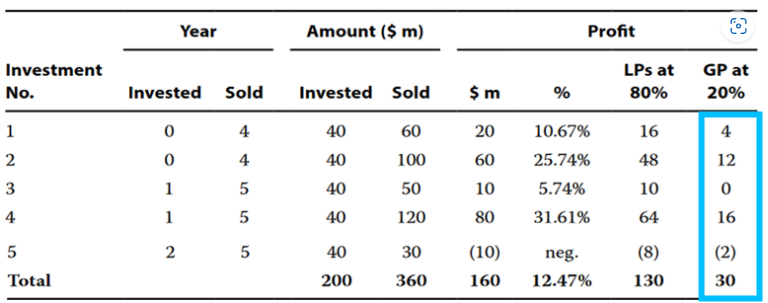

The fund made five investments, tabulated as follows:

What is the total carried interest to the GP?

选项:

A.$30 million

B.$32 million

C.$34 million

解释:

A is correct. The distribution of profit of each investment is as follows:

Since the preferred return of the LP is 8%, Investments 1, 2, and 4 all meet the criterion and the profit is split 80/20 between the LPs and GP. Investment 3 does not earn the GP any carry because it fails to meet the preferred return; neither does Investment 5, whose profit is negative. Because of the clawback clause, the GP’s carry is reduced by $2 million (or 20% of the loss on Investment 5). Therefore, the total carried interest adds up to $30 million, or 30/160 = 18.75% of the total profit made by the fund.

30million到底是怎么算的?