NO.PZ2020012005000020

问题如下:

If a stock index, interest rate, and dividend yield remain constant, derive a formula for the futures price at time t in terms of the futures price at time zero. Suppose that the risk-free rate is 5% per year and the dividend yield on an index is 3% per year. If the stock index stays constant, at what rate does the futures price grow? (All rates are expressed with annual compounding.)

解释:

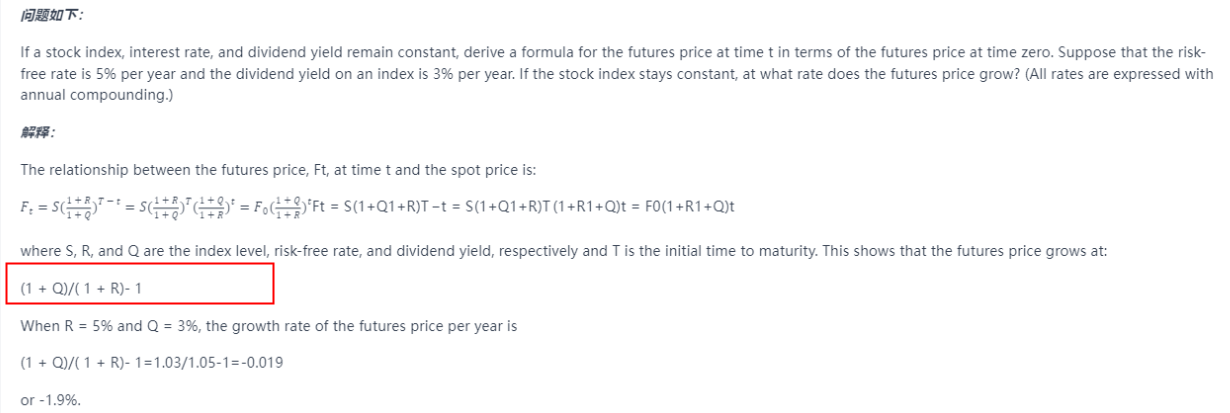

The relationship between the futures price, Ft, at time t and the spot price is:

where S, R, and Q are the index level, risk-free rate, and dividend yield, respectively and T is the initial time to maturity. This shows that the futures price grows at:

(1 + Q)/( 1 + R)- 1

When R = 5% and Q = 3%, the growth rate of the futures price per year is

(1 + Q)/( 1 + R)- 1=1.03/1.05-1=-0.019

or -1.9%.

F=S(1+Q)/(1+R)用的是上面推出的哪个公式?每个公式都带着T-t次方或者t次方,但是这里没有的原因?