NO.PZ2023090501000087

问题如下:

An investment analyst is calculating the forward bucket 01 of a bond. The bond pays a 5% coupon annually, has a face value of CNY 100,000, and matures in 3 years. The analyst notes that the forward rate curve is flat at 3% (with all forward rates calculated for 1-year periods), and uses two forward buckets of 0-2 years and 2-3 years. What is the forward bucket 01 of the bond for the 2-3 year bucket, assuming an upward shift in interest rates?

选项:

A.CNY 9.33

B.CNY 19.11

C.CNY 20.04

D.CNY 27.98

解释:

Explanation

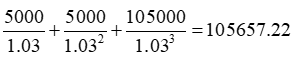

A is correct. The current value of the bond is:

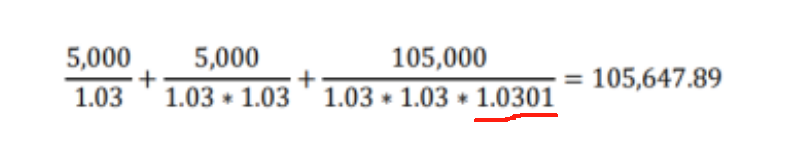

When forward rates in the 2-3 year forward bucket are increased by 1 bp, the value of the bond becomes:

The forward bucket 01 is the difference between these values: 105,657.22 - 105,647.89 = CNY 9.33

Section Valuation and Risk Models

Learning Objective Relate key rates, partial 01s, and forward-bucket 01s and calculate the forward bucket 01 for a shift in rates in one or more buckets.

Reference Global Association of Risk Professionals. Valuation and Risk Models. New York, NY: Pearson, 2022. Chapter 13. Modeling Non-Parallel Term Structure Shifts and Hedging.

为啥后面是1.0301了 ,我是不是哪里没听懂这节课。。