NO.PZ2021061002000049

问题如下:

QWR is a financial intermediary active in

both futures and forward markets.

Now, QWR acts as a futures broker to help

its clients clear and settle their commodity futures margin positions with

futures exchanges.

Here is the information about the copper futures

market:

Now, one of the QWR clients enters a

one-month copper futures contract, and the spot price of the copper is $4 a

pound, the risk-free rate is 1.5% and constant. Each contract incurs a storage

charge of $10.50 at the end of the month.

Which of the following descriptions of

margin accounts is correct?

选项:

A.If copper futures prices immediately fall

below $3.8454 per pound or below $96,135 per contract, the client will receive

margin calls.

If copper futures prices immediately fall

below $3.6054 per pound or below $90,135 per contract, the client will receive

margin.

Since futures are settled daily, we cannot

determine the exact futures price at which margin calls are made.

解释:

中文解析:

由表格可知该铜期货合约的初始保证金是10,000.维持保证金是6,000.

因此当保证金水平低于6,000时,会收到追加保证金的通知,即期货合约价格下降的空间为4,000美元,即每磅允许下跌0.16美元(= 4,000/25,000美元)。

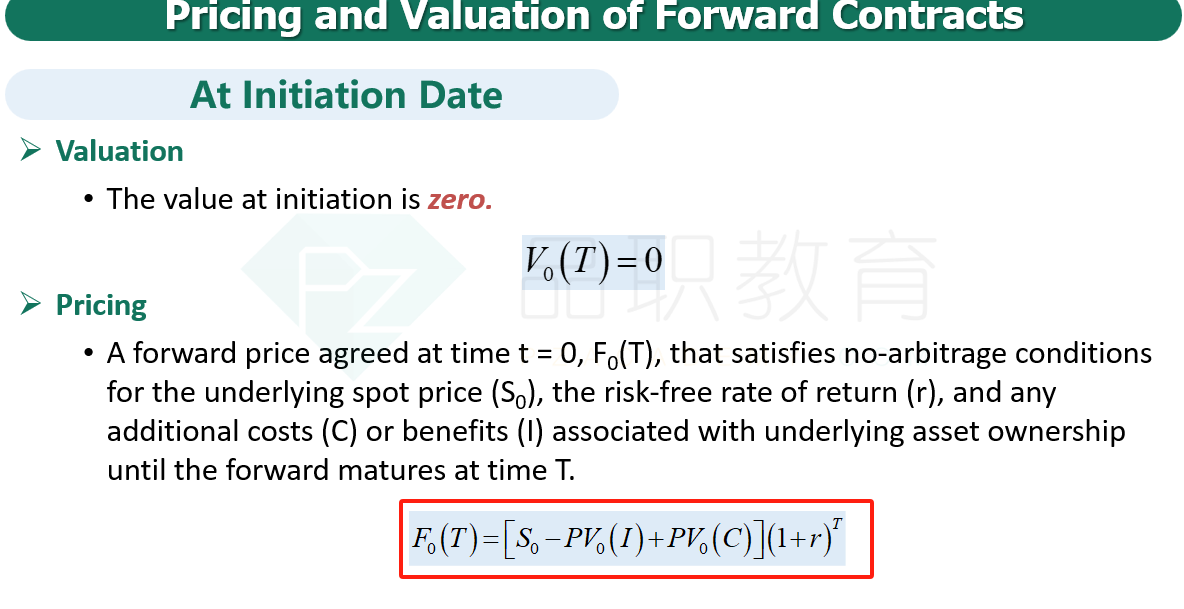

计算期货合约的价格f0(T):

f0(T) = (S0) (1 + r) T+FV(C)

= [(4 x 25000) (1.015 (1/12))]+10.50 =100,135

因此当合约价格低于96,135美元(每份合同100,135美元- 4,000美元= 96,135美元)时,需要追加保证金。

另外,由于每份合同是100,135美元,对应的是每磅4.0054美元。

因此当价格低于3.8454美元(每磅4.0054美元- 0.16美元= 3.8454美元)时,会收到保证金催收电话。

计算期货合约的价格f0(T):

f0(T) = (S0) (1 + r) T+FV(C) = [(4 x 25000) (1.015 (1/12))]+10.50 =100,135

这公式哪来的?为啥那仓储成本不用折现?