NO.PZ2023090401000025

问题如下:

Question An analyst is evaluating the performance of a portfolio of Mexican equities that is benchmarked to the IPC Index. The analyst collects the information about the portfolio and the benchmark index, shown below:

What is the Sharpe ratio of this portfolio?

选项:

A.

0.036

B.

0.047

C.

0.389

D.

0.558

解释:

Explanation:

D is correct.

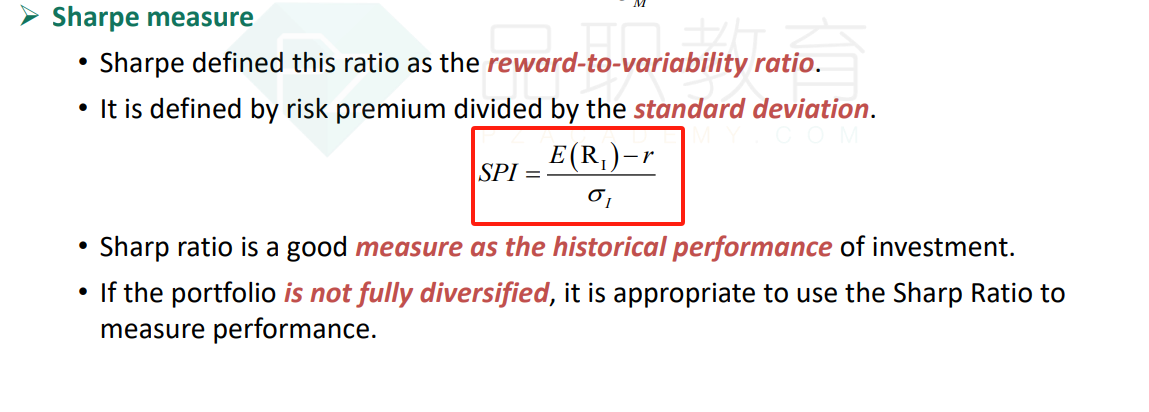

The Sharpe ratio for the portfolio is:

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑓 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 / 𝑅𝑖𝑠𝑘 𝑓𝑟𝑒𝑒 𝑟𝑎𝑡𝑒 𝑉𝑜𝑙𝑎𝑡𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛𝑠 𝑜𝑓 𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 = (8.7% − 2.0%)/12.0% = 0.5583

Section: Foundations of Risk Management

Learning Objective: Calculate, compare, and interpret the following performance measures: the Sharpe performance index, the Treynor performance index, the Jensen performance index, the tracking error, information ratio, and Sortino ratio.

Reference: Global Association of Risk Professionals. Foundations of Risk Management. New York, NY: Pearson, 2022. Chapter 5. Modern Portfolio Theory and the Capital Asset Pricing Model.

sharpe ratio的被除数是expected return of the portfolio, 题目表格中直接给了,请问为什么还需要减去risk free的2%呢。谢谢解答。