NO.PZ2023040301000069

问题如下:

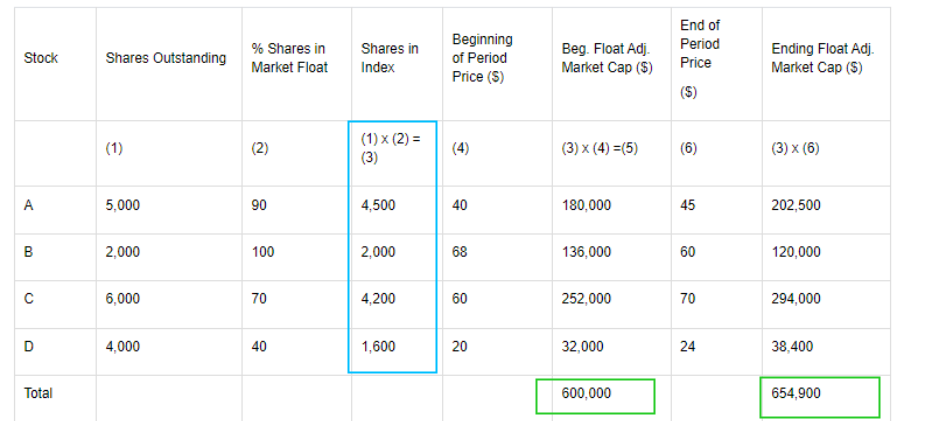

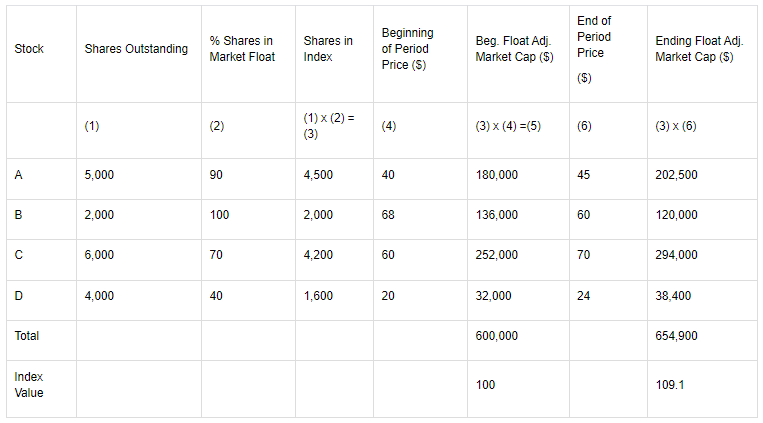

The data for four stocks in an index are as follows:

Assuming the beginning value of the float-adjusted market-capitalization-weighted equity index is 100, the ending value is closest to:

选项:

A.109.1

110.9

111.3

解释:

In float-adjusted market-capitalization weighting, the weight on each constituent security is determined by adjusting its market capitalization for its market float. Per computations shown below, the ending value of the index so computed equals 109.1. (654,900 ÷ 600,000)

有点想不通包含分红的indexed total return 要怎么算