NO.PZ2015121810000002

问题如下:

Last year the return on Harry Company stock was 5 percent. The portion of the return on the stock not explained by a two-factor macroeconomic factor model was 3 percent. Using the data given below, calculate Harry Company stock’s expected return.

Macroeconomic Factor Model for Harry Company Stock

(备注:课后题原题,虽然题目形式是问答题,但是建议不用纠结题目形式,了解题目考查角度即可)

选项:

解释:

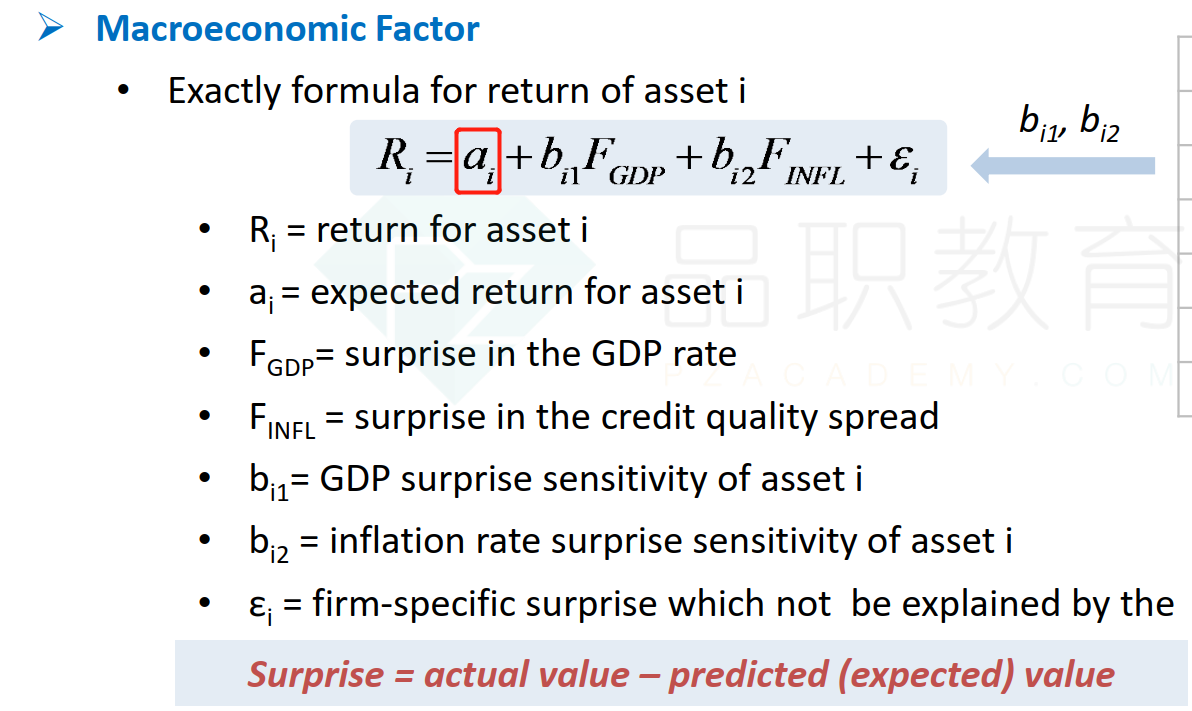

In a macroeconomic factor model, the surprise in a factor equals actual value minus expected value. For the interest rate factor, the surprise was 2 percent; for the GDP factor, the surprise was –3 percent. The intercept represents expected return in this type of model. The portion of the stock’s return not explained by the factor model is the model’s error term.

5% = Expected return – 1.5(Interest rate surprise) + 2(GDP surprise) + Error term

= Expected return – 1.5(2%) + 2(–3%) + 3%

= Expected return – 6%

Rearranging terms, the expected return for Harry Company stock equals 5% + 6% = 11%.

老师,请问为什么预期收益=5%+6%呢?怎么理解呀