NO.PZ201602060100001002

问题如下:

Percy Byron, CFA, is an equity analyst with a UK-based investment firm. One firm Byron follows is NinMount PLC, a UK-based company. On 31 December 2018, NinMount paid £320 million to purchase a 50 percent stake in Boswell Company. The excess of the purchase price over the fair value of Boswell’s net assets was attributable to previously unrecorded licenses. These licenses were estimated to have an economic life of six years. The fair value of Boswell’s assets and liabilities other than licenses was equal to their recorded book values. NinMount and Boswell both use the pound sterling as their reporting currency and prepare their financial statements in accordance with IFRS.

Byron is concerned whether the investment should affect his "buy" rating on NinMount common stock. He knows NinMount could choose one of several accounting methods to report the results of its investment, but NinMount has not announced which method it will use. Byron forecasts that both companies’ 2019 financial results (excluding any merger accounting adjustments) will be identical to those of 2018.

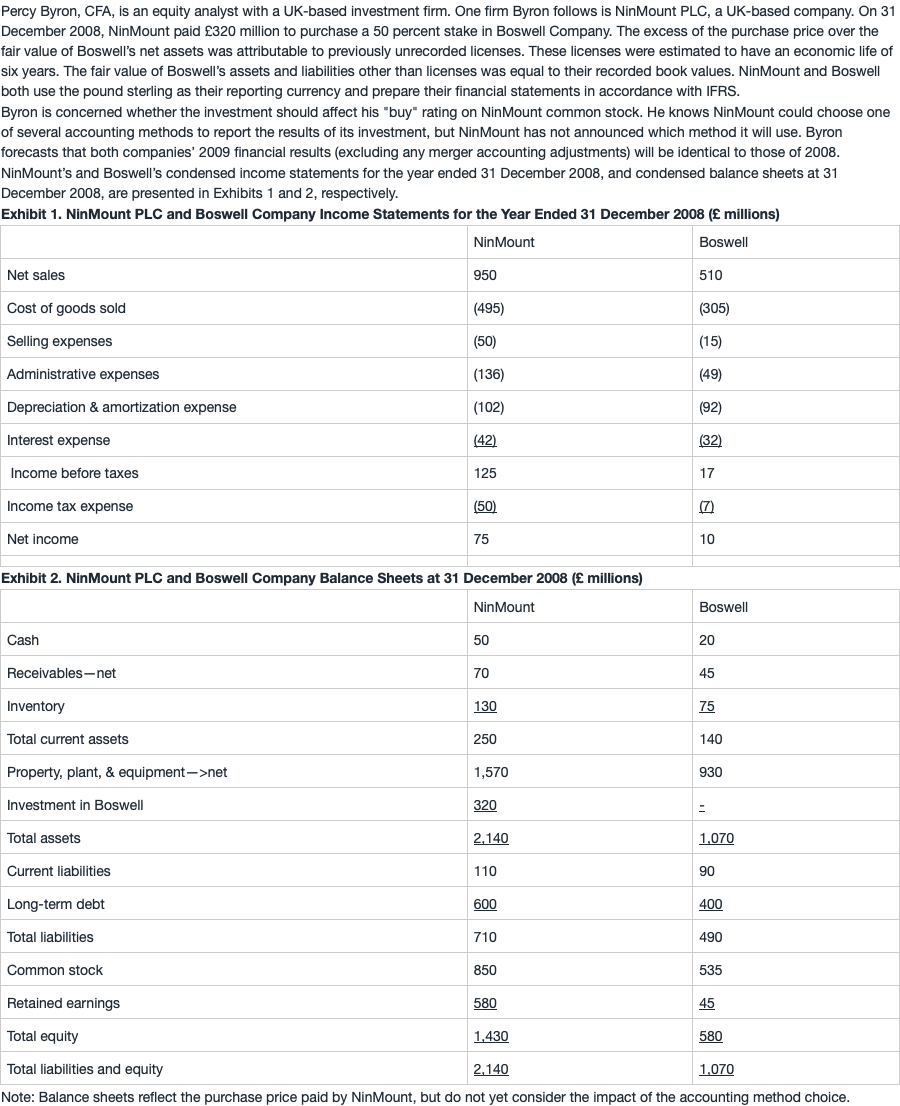

NinMount’s and Boswell’s condensed income statements for the year ended 31 December 2018, and condensed balance sheets at 31 December 2018, are presented in Exhibits 1 and 2, respectively.

Exhibit 1. NinMount PLC and Boswell Company Income Statements for the Year Ended 31 December 2018 (£ millions)

Exhibit 2. NinMount PLC and Boswell Company Balance Sheets at 31 December 2018 (£ millions)

Note: Balance sheets reflect the purchase price paid by NinMount, but do not yet consider the impact of the accounting method choice.

NinMount’s long-term debt to equity ratio on 31 December 2018 most likely will be lowest if the results of the acquisition are reported using:

选项:

A.the equity method.

B.consolidation with full goodwill.

C.consolidation with partial goodwill.

解释:

A is correct.

Using the equity method, long-term debt to equity = £600/£1,430 = 0.42. Using the consolidation method, long-term debt to equity = long-term debt/equity = £1,000/£1,750 = 0.57. Equity includes the £320 noncontrolling interest under either consolidation. It does not matter if the full or partial goodwill method is used since there is no goodwill.

考点 : 不同的会计方法对财务比率的影响

解析 :

2018年末也就是投资发生的时点。equity method是one-line consolidation,只在投资公司的资产中增加一项investment in associate,cash减少相同金额。不对被投资公司的资产和负债进行合并。如果使用equity method,直接用NinMoun自己的debt和equity相除:long-term debt to equity= £600/£1,430 = 0.42

如果使用consolidation method,因为百分百合并了子公司的资产和负债,但其实只支付了50%投资比例所对应的cash,因此资产端会多一块,需要在母公司equity里增加MI(Minority interest)来调平。equity=£1,430+320(MI )=£1,750

long-term debt to equity=(£600+£400)/£1,750 = 0.57

※ 计算MI的方法:

MI计算公式有两个,分别对应full goodwill method和partial goodwill method,但本案例中没有产生goodwill(具体原因可以看上一小问的解析),因此不管是full goodwill method还是partial

goodwill

method,两种计量方法得到的MI相同。换句话说,只有在存在goodwill的情况下,不同goodwill计量方法下的MI才有区别。从计算公式来看:

full goodwill method下:MI =(acquisition cost / % of interests acquired) × (% of non-controlling interest)

partial goodwill method下:MI = FV of net identifiable assets × (% of non-controlling interest)

本题中没有goodwill,acquisition cost/% of interests acquired=FV of net identifiable assets=320/50%=640,MI=640×50%=320。两种方法计算的MI相同。从这个角度思考的话可以直接排除BC,因为两个选项没有区别。

题目表面拿320买50%的股权,多出的部分算在unrealized license里面,多出的部分为320-50%*580 = 30

这30是不是得加进子公司报表的intangible asset里面,也就是说子公司的net asset 从 580 变成了610,用这个办法算出的MI是320

问题就是并表的时候,子公司报表要不要多记这30的unrealized license后,和母公司合并报表