NO.PZ2022120703000078

问题如下:

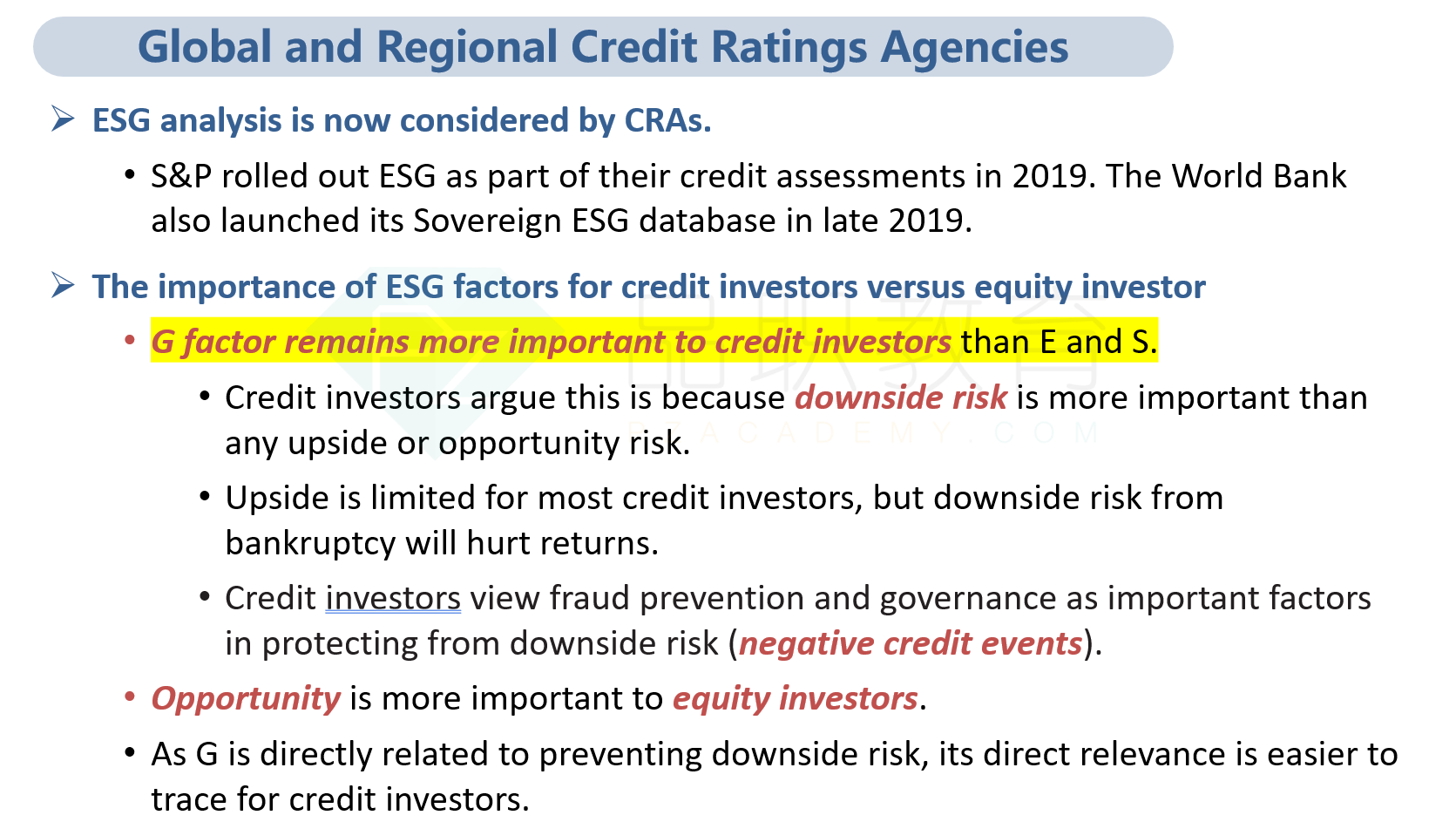

When credit investors argue that downside risk is more important than upside risk, they are most likely focused on:

选项:

A.social factors.

B.governance factors.

C.environmental factors.

解释:

B is correct because "surveys from investors suggest that the G factor remains more important to credit investors than E and S. Credit investors argue this is because downside risk (as in bankruptcy risk and therefore, the chance of losing a credit investor’s entire capital) is more important than any upside or opportunity risk. As G is directly related to preventing downside risk, its direct relevance is easier to trace for credit investors."

A is incorrect because "surveys from investors suggest that the G factor remains more important to credit investors than E and S."

C is incorrect because "surveys from investors suggest that the G factor remains more important to credit investors than E and S."

请问这在讲义的什么位置?