NO.PZ2022123002000050

问题如下:

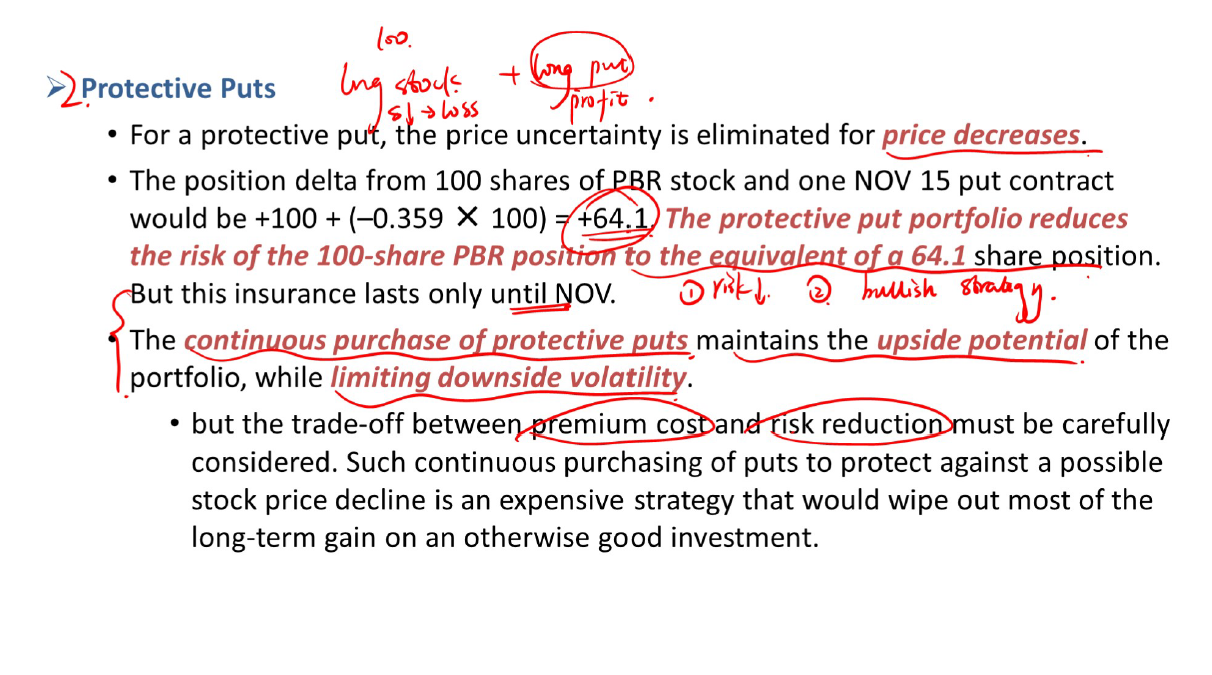

Huanca recently received 3.2 million common stock shares of UrubambaCopper, Ltd. in partial payment for a mining equipment company he sold toUrubamba. The terms of the sale require him to hold this stock for at least 18months before selling it. Although Huanca believes Urubamba is a well-runcompany, its share price is closely tied to commodity prices, which he believesmight decline. He tells Mamani, "I know I can use options on Urubamba tomanage the risk of my concentrated stock position. Either a covered callstrategy or a protective put strategy will reduce the volatility of my positionand establish a minimum value for it, but the covered call strategy will alsoenhance my return if Urubamba's price remains stable, and the protective putstrategy will not."

Huanca'scomment about using options to manage the risk of his Urubamba common stockposition is least likely correct regarding:

选项:

A.

establishinga minimum value

B.

reductionof volatility

C.

returnenhancements

解释:

Correct Answer: A

Although aprotective put establishes a minimum value for the position when the price ofthe underlying stock declines, a covered call does not. Therefore, Huanca'sstatement is incorrect.

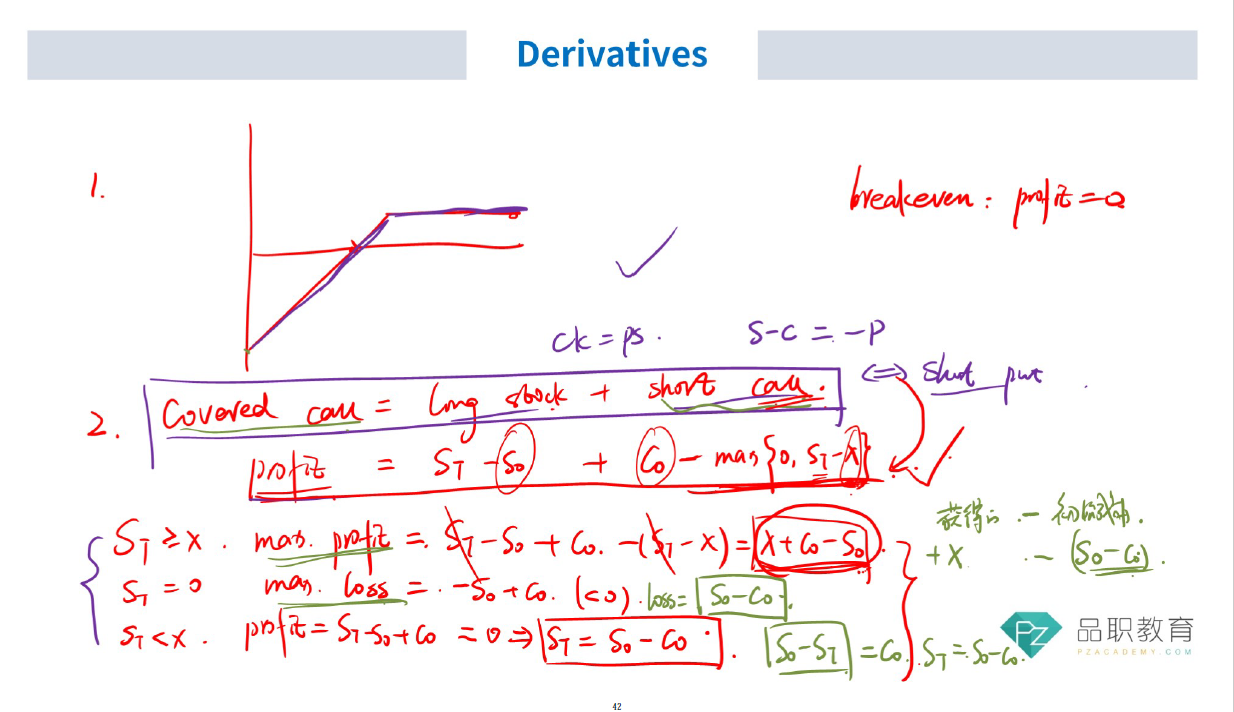

但是,从图形上看,covered call也有minimum value呀,股价最多跌到0,那loss也不会更低了,如图。

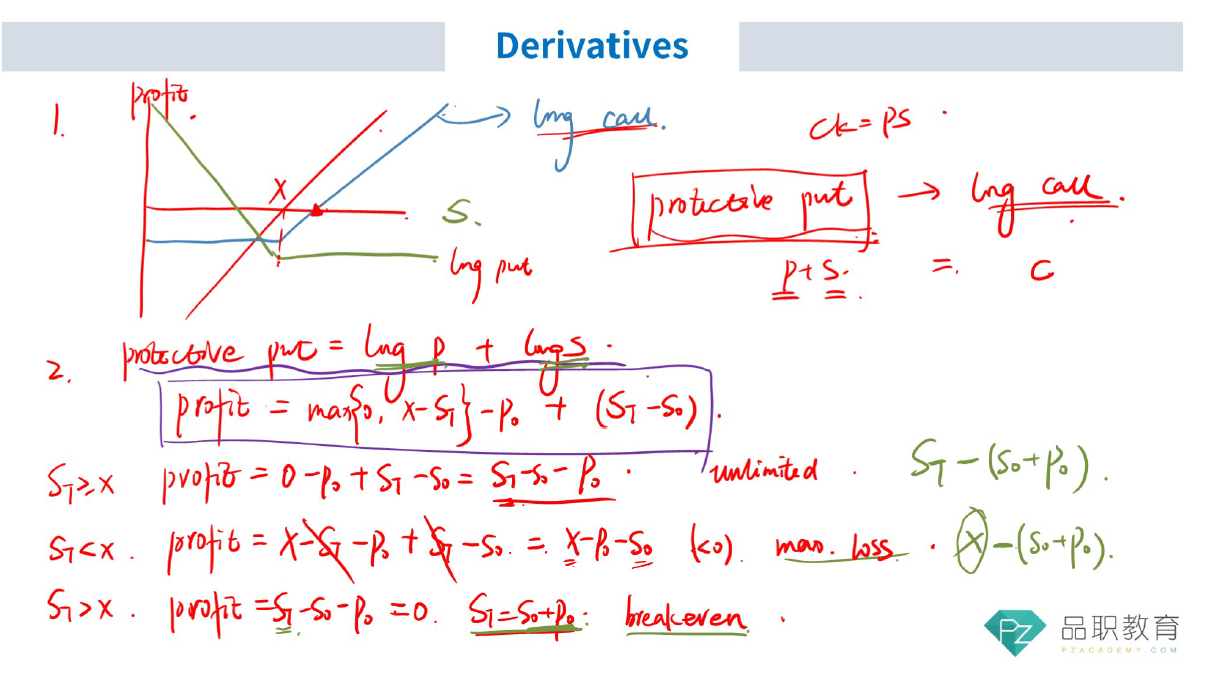

而且return enhancement, 原文说价格变化不大,但我们不知道St,S0和K谁大谁小,至少从题目的表述中看不出来,那这样的话未必short call收到的期权费能覆盖-max(St-K, 0)吧,如果现在以及未来股价都远高于执行价的话