NO.PZ202304050100011701

问题如下:

(1) If Takahashi’s interpretation of the current phase of the property and casualty market is correct, a cyclical shift is most likely to result in:

选项:

A.a tightening of underwriting standards.

capital adequacy being easier to achieve.

additional competitors entering the market.

解释:

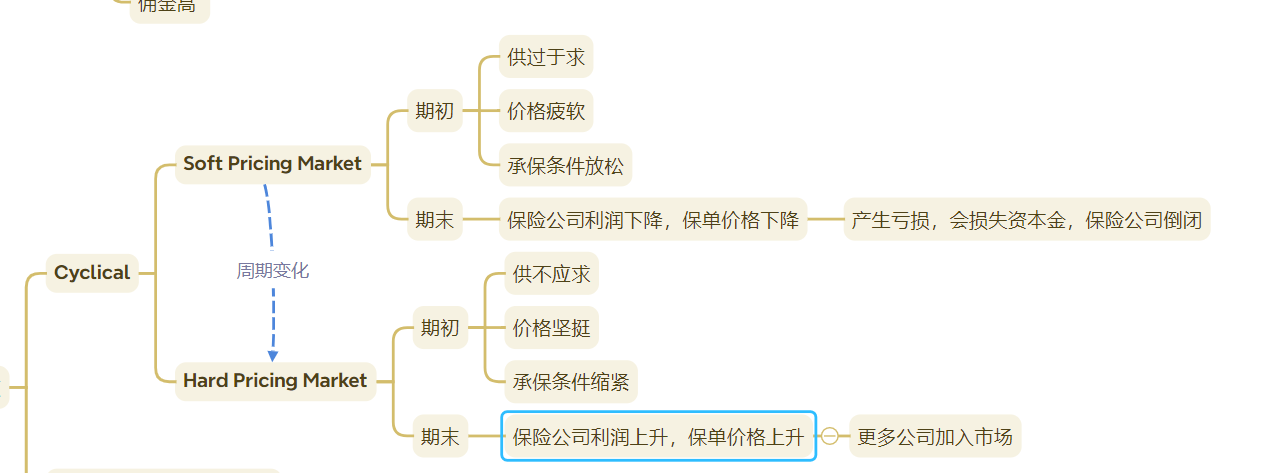

C is correct. In hard insurance markets, insurance premiums and industry profits are high as are underwriting standards. This attracts competitors that offer lower premiums resulting in lower profitability, a softening of the market, and a weakening of underwriting standards.

A is incorrect. In hard insurance markets, premiums and profitability are high and insurers can set high underwriting standards. As competitors are attracted to this profitability and the market softens, underwriting standards and premiums drop as everyone offers the cheapest deals.

B is incorrect. Hard markets feature higher premium prices, increased profitability, and an increased ability for insurers to maintain adequate capital. Capital typically depletes as markets soften, making capital adequacy more difficult to achieve.

就是关于Hard和Soft phase的特性和转变,谢谢!