NO.PZ201604030300004401

问题如下:

1. When recommending Vanderon convert to a PlusAccount, does Klein violate any CFA Institute Standards of Professional Conduct?

选项:

A.No.

B.Yes, because he does not have a reasonable basis.

C.Yes, because the account is unsuitable for Vanderon.

解释:

A is correct.

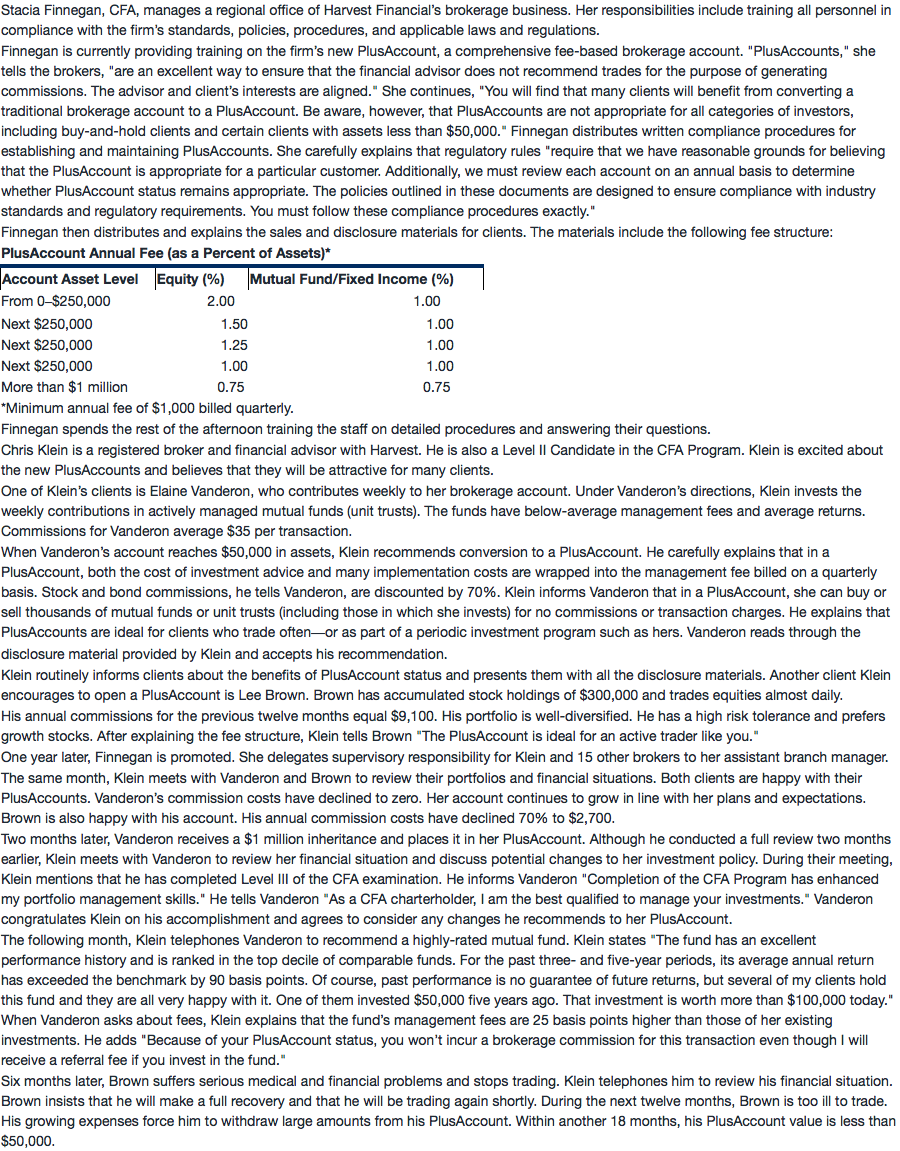

Klein does not violate the CFA Standards of Professional Conduct when recommending a PlusAccount to Vanderon. His actions comply with Standard III(A) — Loyalty, Prudence, and Care; Standard III(C) —Suitability; and Standard V(A) — Diligence and Reasonable Basis. As required, Klein discloses the fee structure associated with the PlusAccount. Based on the fee structure and Vanderon’s trading activity, the PlusAccount appears to be a suitable investment vehicle. By converting to PlusAccount status, Vanderon will incur an annual fee of $1,000 and eliminate approximately $1,800 in annual brokerage commissions. The potential savings of approximately $800 provides a reasonable basis for recommending PlusAccount status.

“When Vanderon’s account reaches $50,000 in assets, Klein recommends conversion to a PlusAccount. He carefully explains that in a PlusAccount, both the cost of investment advice and many implementation costs are wrapped into the management fee billed on a quarterly basis. Stock and bond commissions, he tells Vanderon, are discounted by 70%. Klein informs Vanderon that in a PlusAccount, she can buy or sell thousands of mutual funds or unit trusts (including those in which she invests) for no commissions or transaction charges. He explains that PlusAccounts are ideal for clients who trade often—or as part of a periodic investment program such as hers. Vanderon reads through the disclosure material provided by Klein and accepts his recommendation.”

前面几段关于PlusAccounts账户的背景介绍中并未提及对于股票和债券的交易佣金有70%的折扣,但是K在跟客户V介绍的时候有提及“Stock and bond commissions, he tells Vanderon, are discounted by 70%”,默认是PlusAccounts账户的设定么?

以为是K为了招揽客户自己编的,因此认为违反了准则。考试的时候遇到这种情况怎么判断?