NO.PZ2024050101000113

问题如下:

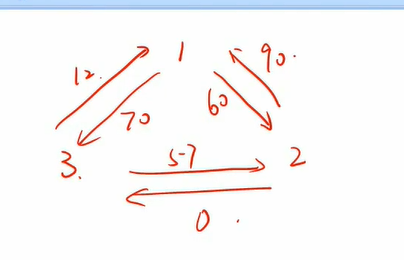

A junior risk analyst at a consulting firm is reviewing the operational arrangements of bilateral netting and central clearing of derivative trades. The analyst examines the following bilateral trades of three firms:

• Firm 1’s exposure to Firm 2: AUD 90 million

• Firm 2’s exposure to Firm 1: AUD 60 million

• Firm 1’s exposure to Firm 3: AUD 12 million

• Firm 3’s exposure to Firm 1: AUD 70 million

• Firm 2’s exposure to Firm 3: AUD 57 million

• Firm 3’s exposure to Firm 2: AUD 0 million

Which of the following statements is correct?

选项:

A.Under bilateral netting, Firm 1’s net exposure is AUD 28 million. B.Under bilateral netting, Firm 2’s net exposure is AUD 27 million.

C.EUR 8 million.

D.Under central clearing, the CCP’s net exposure is AUD 28 million.解释:

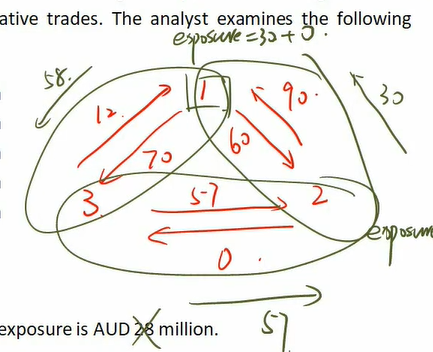

D is correct. The CCP’s net exposure is AUD 28 million under central clearing. We express the positions – through the process of novation and netting – and present the results shown both in the table and the explanations below (note that a negative net exposure means a zero exposure)

NO.PZ2024050101000113

问题如下:

A junior risk analyst at a consulting firm is reviewing the operational arrangements of bilateral netting and central clearing of derivative trades. The analyst examines the following bilateral trades of three firms:

• Firm 1’s exposure to Firm 2: AUD 90 million

• Firm 2’s exposure to Firm 1: AUD 60 million

• Firm 1’s exposure to Firm 3: AUD 12 million

• Firm 3’s exposure to Firm 1: AUD 70 million

• Firm 2’s exposure to Firm 3: AUD 57 million

• Firm 3’s exposure to Firm 2: AUD 0 million

Which of the following statements is correct?

选项:

A.Under bilateral netting, Firm 1’s net exposure is AUD 28 million.

B.

Under bilateral netting, Firm 2’s net exposure is AUD 27 million.

C.

EUR 8 million.

D.Under central clearing, the CCP’s net exposure is AUD 28 million.

解释:

D is correct. The CCP’s net exposure is AUD 28 million under central clearing. We express the positions – through the process of novation and netting – and present the results shown both in the table and the explanations below (note that a negative net exposure means a zero exposure)