NO.PZ2023052301000020

问题如下:

A non-callable, fixed-coupon bond has a price of 106.0625 and a YTM of 2.8%. If the YTM were to increase instantaneously by 80 bps, the price of the bond would decrease by 11%. If the YTM were to decrease instantaneously by 80 bps, the price of the bond would increase by:

选项:

A.less than 11%.

exactly 11%.

more than 11%.

解释:

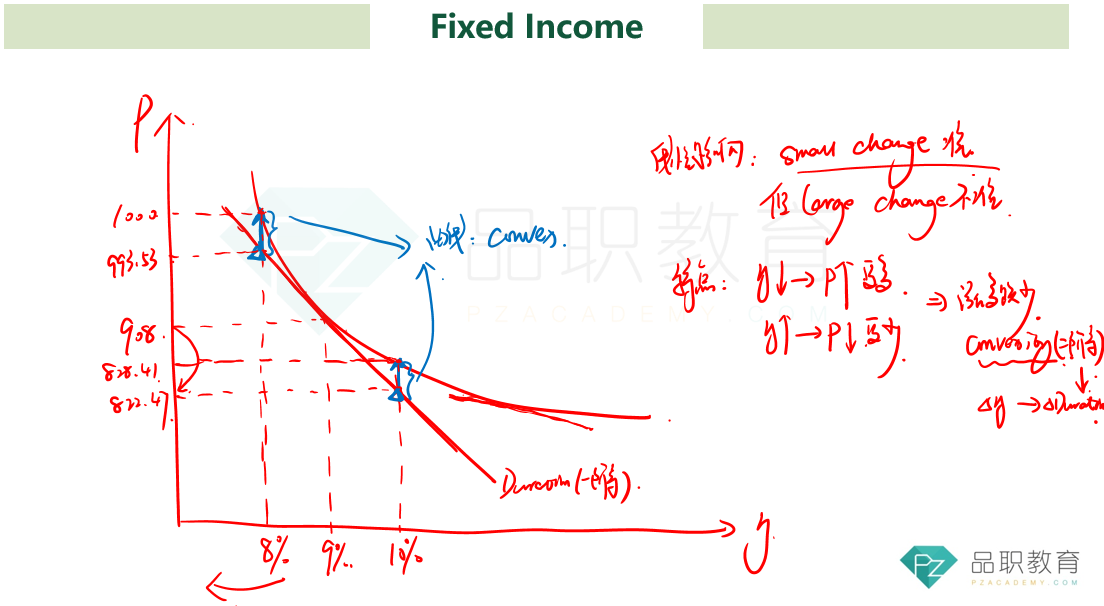

C is correct. The absolute amount of the price increase would be more than the absolute amount of the price decrease for the same absolute change in YTM because of the convex relationship between bond price and yield.

A is incorrect because of the positive convex relationship between bond price and yield. For a given level of yield change, the price rise for that given amount of yield decrease will be larger than the price decline for that amount of yield increase.

B is incorrect because the relationship between bond price and yield is not linear.

不是涨多跌少吗?这道题怎么理解?