NO.PZ2023032701000097

问题如下:

The meeting continues with Kaminski providing some follow-up from the club’s last meeting:

“I have more information on KPK Inc., which we discussed in our last meeting. You may recall that we settled on a discounted cash flow model that we considered appropriate for the stock. I have used it to calculate the justified fundamental P/E. In addition, along with current and forecasted EPS for the next four quarters, I have determined other P/Es for the stock (Exhibit 3). Because the stock is part of the NYSE Consumer Goods Index that Zhang mentioned earlier, I have also included the index P/E. Based on this analysis, I recommend that the club buy KPK shares.”

Which of the following best supports Kaminski’s recommendation for KPK? The justified (fundamental) P/E is greater than the:

选项:

A.trailing P/E

forward P/E

index P/E

解释:

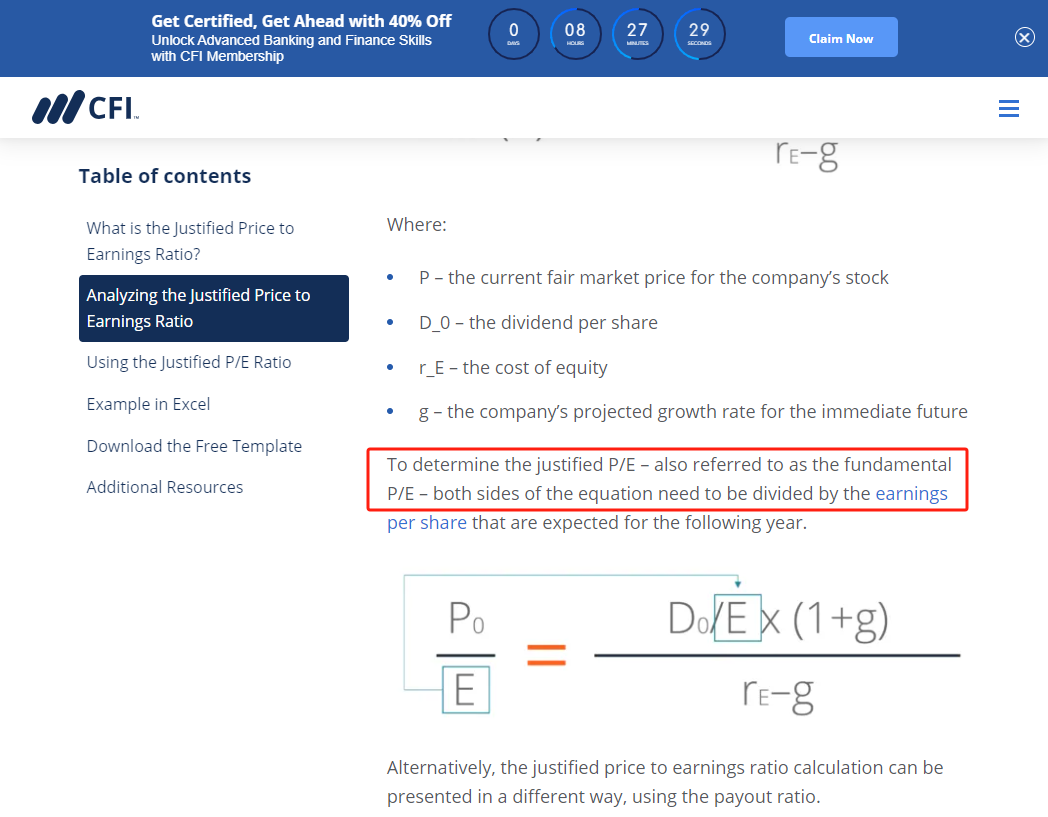

Kaminski recommends that the club invest in KPK. That would be appropriate if the company is currently undervalued. He has forecasted a share price based on fundamentals (DCF) and has forecasted EPS. Therefore, the club can calculate a justified (fundamental) P/E based on those inputs and compare it with the other P/E values to determine the attractiveness of the stock. The justified (fundamental) P/E would be a better metric to base the decision on than one of the other P/Es because it is supported by company fundamentals. From Exhibit 3, the justified (fundamental) P/E is greater than the trailing P/E. Therefore, KPK is currently undervalued by (15.0 – 14.6) ÷ 14.6 = 2.7%, and the club should invest.

B is incorrect. The forward P/E is not the most reliable P/E, because it is not based on company fundamentals.

C is incorrect. The index is a general comparable and does not represent the value of the company as well as the justified P/E. Therefore, it not as reliable a buy signal.

没太懂B为什么错?,基于leading P/E不是更能反映公司未来可持续经营价值吗