NO.PZ2023041102000033

问题如下:

Based on the latest data, an analyst projects that 3.25% real growth in the future and 3.75% inflation. He also forecasts that over the long run, equity market will return 13.5% per year—11% annual appreciation and 2.5% dividend yield—forever. Assuming the macroeconomic forecasts are accurate, which conclusion can be obtained underlie the forecast of 11% equity market appreciation (over the long run)?选项:

A.expansion in the P/E multiple is zero B.the combined contribution from expansion in the P/E multiple and change in shares outstanding of GDP is 4% C.there is not enough information to obtain the conclusion.解释:

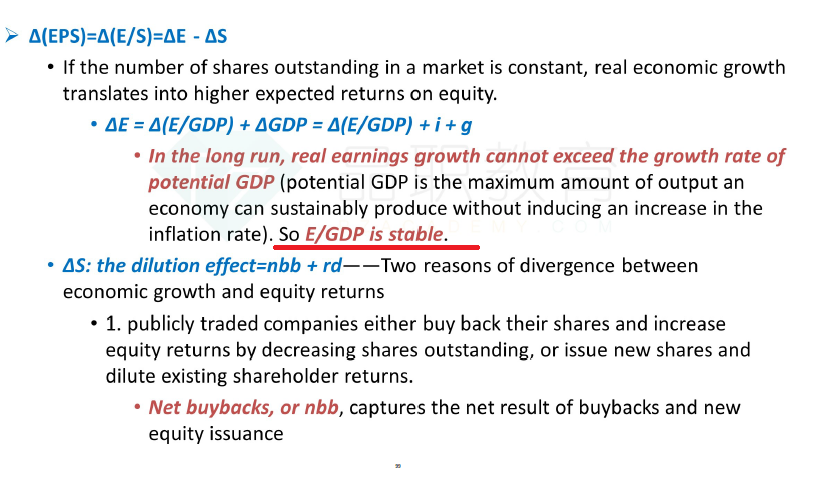

Using the Grinold-Kroner framework, equity market returns can be attributed to (1) dividend yield, (2) expansion/contraction of the price-to-earnings ratio, (3) nominal GDP growth, and (4) change in shares outstanding. The macroeconomic forecast indicates that nominal GDP will grow at 7% (3.25% real + 3.75% inflation). So, the analyst’s forecast of 11% equity market appreciation implies a 4% annual combined contribution from expansion in the P/E multiple and/or change in shares outstanding of GDP over the long run.

由Grinold-Kroner框架可得,股票市场回报可以归因于

(1)股息收益率,

(2)市盈率的扩张/收缩,

(3)名义GDP增长,

以及(4)流通股的变化。

宏观经济预测显示名义GDP将增长7%(实际3.25% +通货膨胀率3.75%)。因此,分析师对11%股市升值的预测意味着,从长期来看,市盈率和/或流通股对GDP的年综合贡献为4%。

股票升值11%,名义GDP7%,股票升值比GDP多出来4%。

说明就这道题的长期来看,P/E、change in shares outstanding、E/GDP这些项不等于0,而是4%。

B只是说了P/E+change in shares outstanding=4%,明显是没有说全呀