NO.PZ2023091802000146

问题如下:

An analyst is doing a study on the effect on option prices of changes in the price of the underlying asset. The analyst wants to find out when the deltas of calls and puts are most sensitive to changes in the price of the underlying. Assume that the options are European and that the Black-Scholes formula holds. An increase in the price of the underlying has the largest absolute value impact on delta for?

选项:

A.Calls deep in-the-money and puts deep out-of-the-money

B.Deep in-the-money puts and calls

C.Deep out-of-the-money puts and calls

D.At-the-money puts and calls

解释:

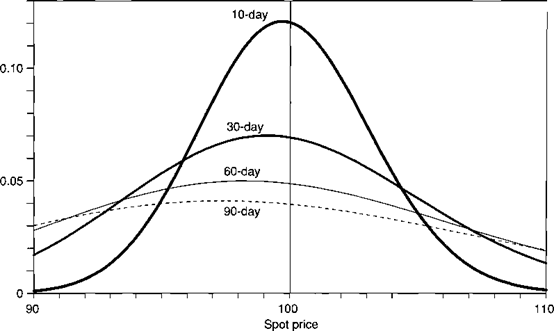

From Figure below, the delta is most sensitive, or gamma the

highest, for ATM short-term options. Under the BS model, gamma is the same for

calls and puts.

Gamma

问题是绝对值最大的是吗? deep in the money 时,call and put delta绝对值靠近1,不是吗?B为什么不对,请老师解答谢谢。