NO.PZ2023032701000040

问题如下:

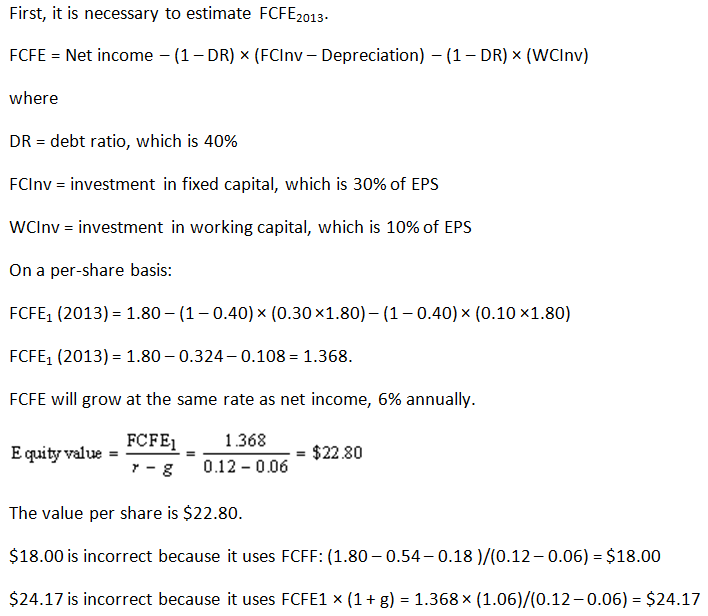

Yee makes the following critical assumptions

• 2013 earnings per share (EPS) will be $1.80.

• EPS will grow forever at 6% annually.

• Cost of equity=12.0%

• For 2013 and beyond:

• Net capital expenditures (fixed capital expenditures minus depreciation) will be 30% of EPS.

• Investments in working capital will be 10% of EPS.

• Of future investments, 60% will be financed with equity and 40% will be financed with debt.

Using Yee’s assumptions and the FCFE valuation approach, the year-end 2012 value per share of McLaughlin’s common stock is closest to:

选项:

A.$24.17

$22.80

$18.00

解释:

如何理解讲义里这个NB的公式需要减去Dep?

实际投入固定资本的现金流不就是FCinv吗?

FCinv - dep = Net PPEt - Net PPEt-1,这个是会计记账上的固定资本投资吧