NO.PZ2023040401000098

问题如下:

According to put–call–forward parity, the difference between the price of a put and the price of a call is most likely equal to the difference between:

选项:

A.forward price and spot price discounted at the risk-free rate.

spot price and exercise price discounted at the risk-free rate.

exercise price and forward price discounted at the risk-free rate.

解释:

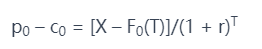

Put-call-forward parity can be written as:

p0 – c0

= [X – F0(T)]/(1 + r)T

This means that the difference between the price of a put and the price of a call is equal to the difference between exercise price and forward price discounted at the risk-free rate.

A is incorrect. Neither put–call parity nor put–call–forward parity support this interpretation.

B is incorrect. Neither put–call parity nor put–call–forward parity support this interpretation.

怎么断句啊= =

如果折现的就是后者,那b是对的 啊